- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Asia faces many macro risks, but a slowing China in not at the top of the list

- Global inflation threat is a non-China factor

- Chinese tourists have been largely non-existent since 2020, hence there is no additional downside

- Asean’s trade with China is a global demand beta that can withstand a domestic demand slowdown

- US interest rates, global capital flows, and food/fuel prices matter more for Asean

Related Insights

Commentary: China slowdown and Asean

China’s nominal GDP was USD17.5trln in 2021, compared to USD14.9trln in the previous year. The year-on-year expansion of USD2.6trln was 22% larger than the expansion of the US. As the largest contributor to global growth, China’s 2022 outlook matters for the rest of the world, particularly Asean, but by how much?

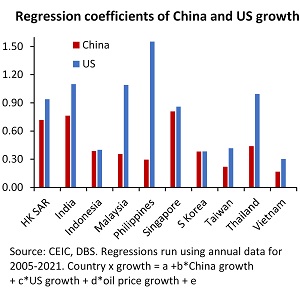

We examine Asean’s reliance on China’s growth by running growth regressions for each Asean country for the period 2005-21, with three independent variables on the right-hand side, real GDP growth rates of China and the US, as well as change in oil prices. We run the exercise using both quarterly and annual data, and find similar results: China matters for Asean growth, but the US much more so. The coefficient estimates vary, but in all cases, the US enters the regression results with a substantially greater magnitude than that of China.

The reason for this is clear; China’s trade linkages with the region are deep and growing, but they are still largely a function to the global trade dynamic as opposed to China’s domestic demand. Many goods produced in Asean countries are intermediate inputs in the supply chain, which go to China for assembly. The linkage also works in reverse; a large chunk of the region’s imports are made-in-China inputs for autos, electrical, and electronics assembly. As long as global demand is holding up, China’s domestic demand headwinds won’t cause regional trade to suffer greatly, in our view. With respect to global demand, the US outlook remains key, as per our analysis.

But what about the large tourism flows from China? Of course, the Chinese have made up for a very significant part of regional tourism in recent years, and a resumption of tourist flows would be supportive of the growth outlook, but given that such flows had trickled to a halt since the spring of 2020, the lack of upside in 2022 won’t really matter, as the base is all but zero.

Granted, the China slowdown dynamic is not helpful. But the key headache stemming from the high price of food and energy has little to do with China, the culprit being the war in Ukraine and other supply-side constraints. If anything, a slowing of Chinese demand could help the commodities inflation outlook.

Additionally, headwinds are coming from rising interest rates, capital flow volatility, and pressure on currency markets. Yet again, these complications are a function of the US Fed’s monetary policy direction, with the PBOC a largely passive actor.

We believe that between the resumption of tourism (even without those from China and Russia), continued demand for exports, and moving past the pandemic, Asean growth could well hold up this year, even as the outlook of China remains beset with uncertainty.

Taimur Baig

To read the full report, click here to Download the PDF.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.