- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- We take stock of our assumptions for India’s FY23 growth outlook

- Reopening momentum and encouraging investment bytes back our optimism

- Yet the global backdrop is turning challenging through a mix of demand and inflation shocks

- We expect the domestic capex cycle to kick-off but not all engines might fire

- Implications for forecasts: We moderate our real GDP growth forecast for FY23

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

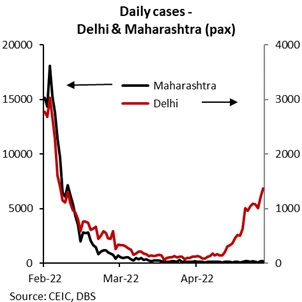

Covid cases inch up, vaccination push

After a sharp fall in cases, India is facing a renewed rise in the daily Covid count albeit at moderate levels. This increase is suspected to be driven by the new sub-lineage of the Omicron variant, but encouragingly, showcasing similar characteristics of being highly transmissible but less virulent/fatal.

Total positivity rate inched up, but the fatality rate is contained at 1.2%. Authorities are keeping an eye on the spread, while reinvigorating the vaccination rollout (~60% are fully vaccinated) and booster dose to the adult population (27.8mn dispensed till 28-Apr), as the run-rate had slowed before the latest increase. Natural immunity from the previous bouts of the infection and inoculation is expected to keep the spread and impact under control.

We take stock of our assumptions for India’s FY23 growth outlook, outlining two buffers and three risks.

TWO BUFFERS

- Reopening momentum to be a friend

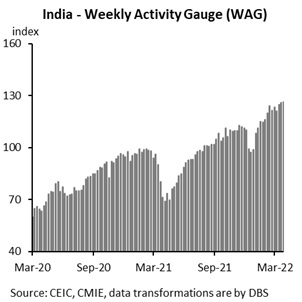

Even as few states experience fresh waves of COVID-19 infections, economic activity is expected to become less sensitive to the vagaries of the pandemic. Our proprietary Weekly Activity Gauge (WAG), which captures high-frequency mobility, power demand, employment etc. remains at above than pre-pandemic levels. Most sectors, including contact intensive retail/ recreation/ airlines etc., are heading back to full capacity as restrictions are unwound and mask mandates are eased in many states (barring those witnessing a recent increase in cases).

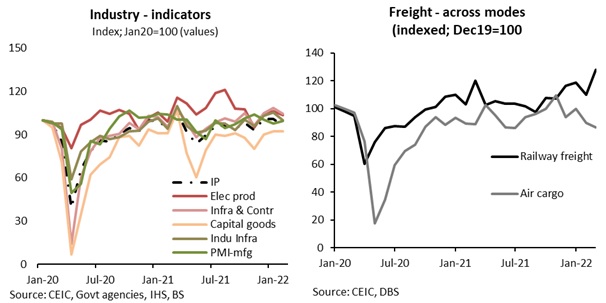

For business activity, we use indexed series to overcome base effect distortions. Most data outrun points to improvement in Jan-Mar22 albeit modestly higher than year ago. PMIs stayed in expansion territory, slowing late in the quarter as companies reported softer expansion in new orders and production. – manufacturing and services. Jan-Feb industrial production rose 1.6% yoy, reversing from the contraction same time last year. Railway freight surpassed late 2019 levels, whilst air cargo is still below pre-pandemic tonnage.

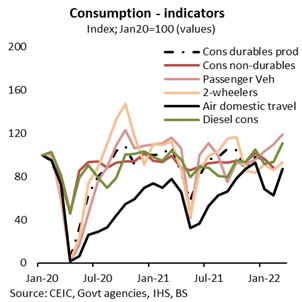

For consumption, reopening boost bodes well for employment even as medium-term scarring slows the pace of rebound as discussed in the next section. Naukri jobspeak index registered a 29% yoy increase in aggregate hiring demand in Jan-Mar22, including BFSI and technology sectors. Add to this, improved mobility, pickup in consumer sentiments (current and forward looking), vehicle sales and personal bank credit growth suggest strong urban demand impulse.

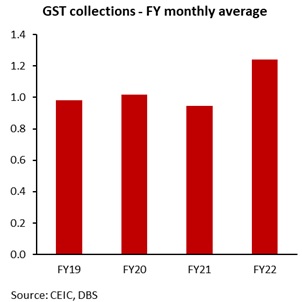

GST collections have been consistently strong, with a record high in Apr22 collections at INR1.68trn, which is partly inflated by fiscal year-end adjustments. A string of strong collections pushed up FY22 monthly average to INR1.2trn, up 30% yoy from the year before. This compares with INR0.94trn in FY21 and INR1.02trn in FY20. A combination of factors is behind this surge, including high inflation, formalisation, better compliance as well as stepped up usage of technology to address evasion.

Parts of the country are experiencing an extreme heatwave in the past month, which is a threat for wheat and vegetables output, driving up near-term costs.

Beyond this, there has few tailwinds in the pipeline for agri demand, for instance a) likelihood of a normal southwest monsoon; b) terms of trade improvement on higher local and global food prices, with the latter reflected in price benefits in agri exports; c) supportive government policies for MNREGA, fertiliser subsides, amongst others. Non-farm sector players, which make two-thirds of rural activity, are expected to benefit via backward linkages with urban industrial and service sector activities.

- Tailwinds for investments, amidst accelerated formalisation

Investment/ capex revival is a key assumption in our FY23 recovery expectations. There is encouraging news on this count.

New investment proposals have continued to climb every quarter in the past four quarters, to INR5.1trn in Jan-Mar22 vs average INR3.1trn in preceding three quarters, according to CMIE data. Investment intentions were however largely concentrated in the power and renewables space and is expected to broaden out in the coming months. The quantum compares favourably with INR2.1trn average in FY21 but lags INR4.5trn average before the pandemic in FY20. The PM’s office is also reportedly taking stock of mega infra projects that can be completed over the next two years.

Credit growth to industry is up 6.8% in Jan-Ma22 vs 1% in the comparable period last year, led by small and medium enterprises which is up strong double digits. Aggregate capacity utilisation rate has risen above 70% after nearly two and a half years, with varied sectoral rates.

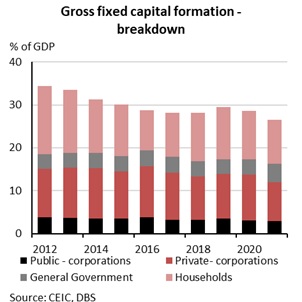

Besides high allocation towards capex in the Budget, the push factor is likely to comprise commitments under the broader framework of national infra pipeline, asset monetisation scheme (FY22 targets met and exceeded) and Gati Shakti program. In the most recent slowdown phase in capex, household GFCF i.e., gross fixed asset capital formation (real estate) and private corporates accounted for majority of the moderation, and thereby a revival in the cycle will require an improvement in both these segments.

THREE RISKS

- Scarring effects still at play

Labour market conditions reflect the uneven improvement from the pandemic. The unemployment rate is down to 7.0-7.5%, yet labour participation rate trails pre-pandemic levels. The employed over labour force ratio averaged 39.6% in the twelve months to Dec19 and has since eased to below 36.5% in Mar22. This reflects the gap in aggregate activity as GDP growth was only a modest 1% above pre-pandemic levels (four quarter moving average) as of Dec21 quarter. Hope is that an improvement in activity will spur an additional 16-18mn additional jobs to return to trend employment ratio.

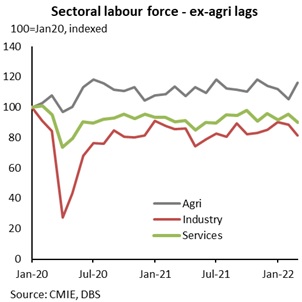

Displaced labour, meanwhile, was absorbed by agriculture and non-farm sectors. Sectoral employment data shows that while the deployment of labour in the agriculture sector remains strong, that of industry and services is still 9-14% below pre-pandemic levels.

Add to this, household demand for the rural employment scheme i.e., MNREGA is still elevated even if lower than mid-2021 which was in wake of the Delta Covid wave. Number of households demanding work in Dec21 is still 30% more than Dec19 level, but lower than 75% jump in mid-21.

In the near-term, there are few other factors to watch.

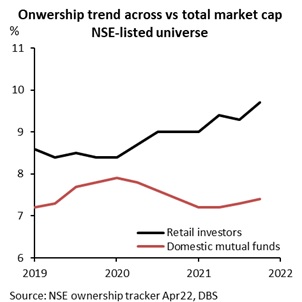

An extended period of negative real rates has pushed more retail investors into riskier alternatives like equity markets. Direct retail share of individual retail investors in Nifty 50, Nifty 500 and NSE-listed companies rose to 14-year high by Dec21, according to the NSE. Rising retail ownership increases exposure to vagaries and volatility in the equity markets, thus causing wealth effect swings in the event of a significant and prolonged correction on valuation worries or global uncertainty.

Next, households saving rate ticked up by 2.6ppt to 22.2% of GDP in FY21, which is likely to have risen further in FY22 before tapering off as the economy reopened, thereby lowering the available excess buffer to finance discretionary spend.

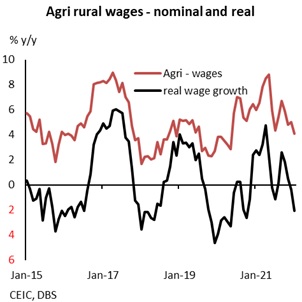

Lastly, rising inflation, spillover of high crude oil prices and tightening policy conditions will impinge on real purchasing power into FY23. Rural real and nominal agri wage growth has been decelerating for the past six months.

Elevated inflation nudged the Reserve Bank of India monetary policy committee to prioritise price stability over growth, as signaled by the hawkish pivot at the April meeting India: Inflation becomes a priority at the RBI. Our FY23 inflation forecast stands at 6.4% yoy, and the quarterly profile effectively leaves inflation in excess of 6% in all quarters of FY23, above the central bank’s projected path.

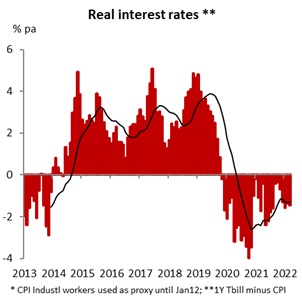

Real rates have been in negative for the past two years, hurting savers. Taking a 12-month forward looking view, inflation is set to average 5.7% (by central bank’s projection), which compares to the repo rate at 4%, which essentially applies than even a neutral real rate will require an adjustment of 170bps. The chart below compares the repo rate to the 1Y T-bill rate to highlight the real rate trend.

Our rate forecast path is for 100bps of hikes in FY23 and 50bp hikes in FY24 first half, which will take the rate to 5.5%. Bias is for more hikes than less, and we continue to monitor the central bank’s rhetoric.

Increase in benchmark rates is likely to result in a rising loan rate environment, as more banks’ rates are pegged to external benchmarks, specially the repo rate. The share[1] of loans linked to the external benchmark rate is up from 9.3% in Mar20 to 39% in Dec21. Amongst different segments, 69% is from MSMEs, 46% retail and 20% large industries credit.

- Challenging global backdrop, inflation a dominant risk

Global growth and financial conditions are entering a tumultous phase in FY23, as the US (and few other advanced economies) seeks to tackle multi-year high inflation with aggrestive rate hikes and balance sheet reduction, China sticking the onerous zero-Covid strategy and Eurozone at the risk of facing a stagflationary shock on geopolitical risks as well as rising energy prices.

Rally in commodity prices, especially oil, carries inherent risks for India’s economic outlook including inflation (India: GDP growth, inflation, and Russia-Ukraine fallout). Concurrently, instances of resource nationalism like Indonesia’s recent move to ban palm oil exports to secure domestic supplies, will have a bearing on India’s inflation and lead to potential shortages, given its high dependency on edible oil imports.

On the external sector, encouragingly goods exports surpassed expectations and set a fresh record high of US$416bn in FY22 on higher manufactured, traditional sectors and commodities. Risks are, however, stacked against the trade balance in FY23. Exports are still expected to reap the benefit of better-faring manufactured goods demand and the potential boost from fiscal incentives to firms across sectors like electronics, specialty chemicals, project goods, auto, etc. Material progress on free trade agreements with countries like Australia, the Middle East, the UK etc., via early harvest agreements and negotiations on deeper collaboration, thereafter, will also be a medium-term tailwind for the external sector. This optimism will encounter a challenging global growth backdrop in 2HFY23, on likely moderating growth in the US, China, and Eurozone. Concurrently a negative term of trade shock from high commodity prices will keep imports high. We expect the FY23 current account deficit to widen to -2.7% of GDP vs -1.5% in FY22.

- Capex cycle expected to take off, but all engines might not fire to capacity

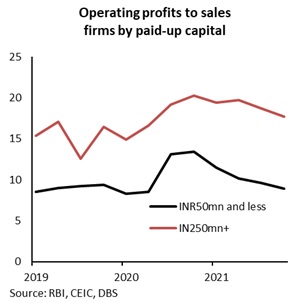

Challenging geopolitics and rally in commodity prices could hurt the profitability of corporates, and in turn introduce caution towards private sector capex commitments. Operating margins are likely to come under pressure for industrial and service sector providers as input prices rise. Output and input price indices have been creeping up, which is likely to catch further momentum.

Moreover, impact of the pandemic has been more pronounced on smaller firms’ vs bigger firms as shown in the chart below. In this environment, onus will fall on the centre and state sto maintain their capex outlays.

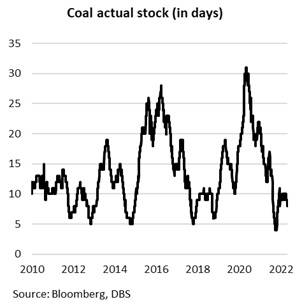

An idiosyncratic risk is that of coal supply shortages, which will have an impact on the manufacturing and industrial sector. Coal stocks (in days) have averaged 8 days this week, better than Oct21 lows of less than 5 days yet lower than long term averages. Coal accounts for three-fourth of domestic power output. Demand has risen sharply in midst of inclement weather (heat waves) across different parts of the country, reopening demand. Supply has been impacted by a sharp rise in global prices and lower imports as well as logistical bottlenecks (e.g., railways).

Electricity shortage as % of demand ratio is 1.4x vs 0.5 in March and 1.0 in Oct21 during the last such bout. Higher demand is channelling supplies away from non-power sectors, hurting production. Heading into the crucial summer months, inadequate coal supplies would hurt industrial and consumption demand, increasing the frequency of blackouts/ shortages, impacting recovery prospects.

For the central government, the fiscal math needs to absorb higher outlays towards social assistance and subsidies in light of a sharp rise in global commodity prices. This might necessitate substituting part of the capex funds for revenue expenditure to stay within targets. Fertiliser subsidy is expected to rise to a record high of INR2.1-2.3trn (0.8% of GDP) vs budgeted INR1.05trn (0.4%), besides the free foodgrain distribution could raise the food subsidy bill by INR0.8trn to INR2.86trn. That said, given conservative growth and revenue assumptions, we don’t expect the FY23 fiscal deficit to deviate from the budgeted -6.4% of GDP.

GDP Nowcast – swings ahead

Our GDP Nowcasting model which provides estimates for 4QFY22 and 1QFY23 quarters suggests a choppy ride – with Mar22 quarter outrun likely to be below 4%, below the central bank’s estimates, followed by a double digit rise in Apr-Jun22 due to base effects.

Revisions to our growth forecast

Tying in two buffers and three risks together, we temper our FY23 growth expectations to 7.0% yoy from 7.5% earlier and more conservative than the central bank’s projection at 7.2%. In a nutshell, risks stem from:

- Slower global growth and high energy prices which is likely to manifest through the trade channel (negative terms of trade) as well as inflationary expectations. A further rally in commodity prices will imply downside risks to our forecast

- Uneven recovery in employment conditions, which sets the stage for a slower pick-up in consumption

- Cost-of-living risks due to higher food/ fuel spends, as reflected by prevailing high inflation (FY23f DBS: 6.4%) and pipeline forces which will impinge on purchasing power, just as central bank hikes, tightening financial conditions

- Centre and states’ expenditure face the risk of reallocating fiscal resources away from capex towards welfare and subsidies (food, fertilizer, etc.) to shield low-income households in case the commodity upcycle extends or prolongs

Building in a high deflator on top of the real GDP growth, nominal GDP is likely to be around 15-17% yoy in FY23, providing a cushion to the fiscal deficit and debt ratios.

Topic

Explore more

E & S FocusThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024