- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- In line with our tilt towards quality, Asset-backed securities offer a viable means of stable income

- Benefits include cash flow visibility, low interest rate sensitivity & low default risk

- Senior tranches often boast investment-grade ratings since they benefit from diversification

- ABS are not exempt from systemic risk but offer access to diverse types of underlying collateral

- Given steady income generation, consider ABS exposure in your allocation to alternatives

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

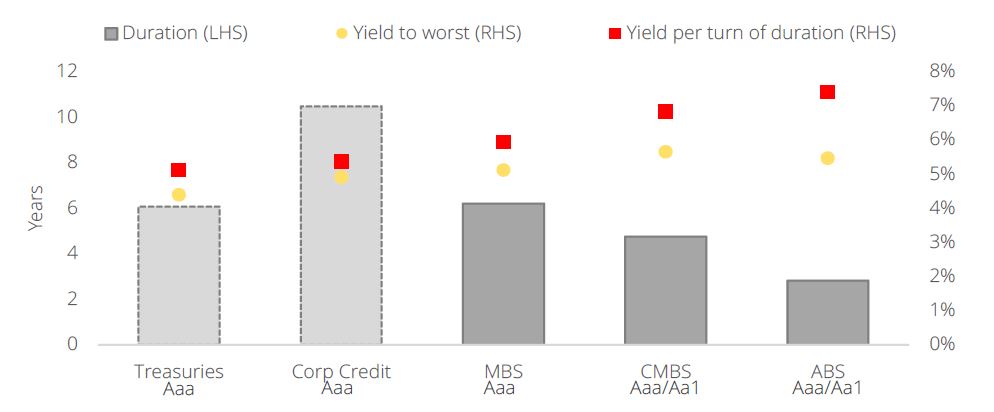

Quality yield comes in many forms. Since early in the year, we have been advocating an up-in-quality stance for risk assets given mounting headwinds in the broader investment landscape. While relatively niche compared to traditional equity and fixed income classes, securitised debt markets are still a viable means of obtaining stable income with quality enhanced by tranche structuring, providing risk mitigation through diversification, and waterfall structures. Due to its relatively small size and perceived complexity, the asset-backed securities (ABS) space is often overlooked, but characteristics of (a) high cash flow visibility, (b) low interest rate sensitivity, and (c) low default risk warrant it a closer look given the macro uncertainties clouding the outlook today.

Figure 1: US asset-backed securities provide competitive yields with low duration

Source: Bloomberg, DBS

What are ABS? ABS are financial securities backed, or collateralised, by contractual cash flows from a pool of cash-generating assets which could be private equity, mortgages, commercial loans, auto loans, student loans, credit card receivables, etc. This pool comprises the same type of assets, involving numerous and diverse payers (e.g. a credit card ABS trust might contain receivables from thousands of individual credit cardholders, while an auto loan ABS trust would contain receivables from thousands of car loans). The inclusion of numerous receivables provides diversification that minimises idiosyncratic risks associated with the individual payers.

A special purpose vehicle (SPV) purchases these assets from the sponsor and simultaneously issues securities to fund its purchase of these assets. This single homogenous pool is then securitised, and quite normally, split into different tranches of varying seniority. The most senior tranches are first in line to receive cash flows from the underlying – cushioning investors against losses but offering the lowest yield, while junior or equity tranches give the highest yield but are most risky since they are first to absorb any losses from the pool. In this way, securities that suit different investor risk and reward preferences are created from one single pool of assets.

Benefits of investing in ABS. Investors in ABS stand to benefit from the following:

- High credit quality – Securitisations are designed such that the most senior tranche is exposed to minimal credit risks and can withstand losses multiple times what is expected from the underlying pool. The safety of senior tranches is engineered through credit enhancements. Examples of credit enhancements include subordination of junior tranches or overcollateralisation (issuing less securities than the value of the collateral). These provide a safety net such that senior tranches are often endorsed with investment-grade ratings, in many cases rated AAA.

- Diversification – ABS structures offer different types of underlying collateral pools ranging from corporate to consumer loans. This offers potential diversification benefits since consumer-related receivables are exposed to credit performance of consumers, offering a different risk profile to bonds, which are usually exposed to corporate credit risks.

- Stable cash flows – Since the underlying assets represent a diversified pool of periodic contractual payments, this offers investors predictable and stable cash flows.

- Higher spreads – To compensate investors for the additional complexity of ABS structures and lower liquidity, ABS are known to offer more generous yields than bonds in the same rating category, giving investors an attractive risk-adjusted return.

- Lower duration – Consumer-related credit such as credit card receivables tend to be based on floating rates and/or have much shorter in maturities than corporate bonds, resulting in ABS generally having lower sensitivity to rising interest rates.

- Insulation from sponsor’s credit risks – ABS investors are protected from credit risk or any potential financial distress of the sponsor, since the SPV issuing the securities is a legally distinct from the sponsor. Repayment of the underlying loans depends on receipt of contractual cash flows from the payers which is independent of the sponsor.

Risks of investing in ABS. There are, however, unique risks to ABS that investors need to keep in mind:

- Liquidity considerations – Due to their smaller market size, ABS markets tend to be less liquid than more established fixed income categories. Hence, investors would do well to consider their investment horizon vis-à-vis the maturity of the instrument and the expected liquidity of their secondary market.

- Complexity – Securitised products have complex structures involving different layers of legal entities and detailed documentation, since securitisations usually involve multiple tranches with different profiles. Furthermore, ABS reporting differs from the usual financial disclosures of corporates that investors might be more familiar with. This could prove daunting especially for first-time investors without the benefit of trusted financial advisors.

- Prepayment risks – This refers to the risk that payers pay more than their periodic contractual requirement, lowering the interest income generated by the pool of assets. While prepayment risk could be significant for structures with longer-term underlying assets, it is generally low for shorter-term loans common amongst consumer payers.

- Systemic risks – Although collateral pools mitigate against individual payer-specific risks, it is important to note that the addition of numerous payers does not diversify against systemic risks. For example, securities issued against a pool of mortgages would be exposed to risks in the real estate market i.e. macroeconomic shocks would lead to highly correlated losses. Many would recall the 2008 collapse of the US subprime mortgage market in which falling house prices led to systemic defaults across mortgage pools – amplified by derivatives – unearthing risks in MBS structures that were understated by credit rating agencies.

Capitalising on strong consumer balance sheets. Within securitised markets, consumer-related segments in particular could offer attractive opportunities, considering that household balance sheets appear poised to weather the storm ahead, having strengthened considerably over the past decade. Investors bracing for uncertainty in the road ahead would find opportunities in consumer-related securitised structures, of which senior tranches provide high credit quality at lucrative yields. Even if cash flows from the underlying collateral pool were to weaken under the pressure of macro headwinds, the senior tranches are likely to remain cushioned by any loss absorption in the subordinated tranches.

Download the PDF to read the report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024