- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- An implosion of the US Commercial Real Estate space will have substantial economic ramifications

- US small bank loans to the commercial real estate sector account for c.7% of US GDP

- However, the likelihood of a GFC redux is low as banks today are better capitalised

- Average TCE/RWA ratio for large banks has improved markedly since GFC

A repeat of 2008 GFC contagion on the cards? Not likely. After the publication of our CIO Perspectives: US Commercial Real Estate – The Next Shoe to Fall (dated 25 April 2023), the questions one would naturally ask are:

- What if the shoe indeed falls and what are the economic implications?

- Will this be a repeat of 2008’s Great Financial Crisis (GFC)?

- What is the impact on global risk assets?

These are valid questions. With the challenges of a slowing economy, persistent inflation, and elevated bond yields, it is only right for portfolio allocators to tackle these issues head-on and prepare for potential economic/financial ramifications should the US commercial real estate (CRE) space implode.

Question 1: What if the shoe indeed falls and what are the economic implications?

- US regional banks will be the hardest hit should the CRE space implode. To determine the potential impact, we look at how exposed the US economy is to this segment.

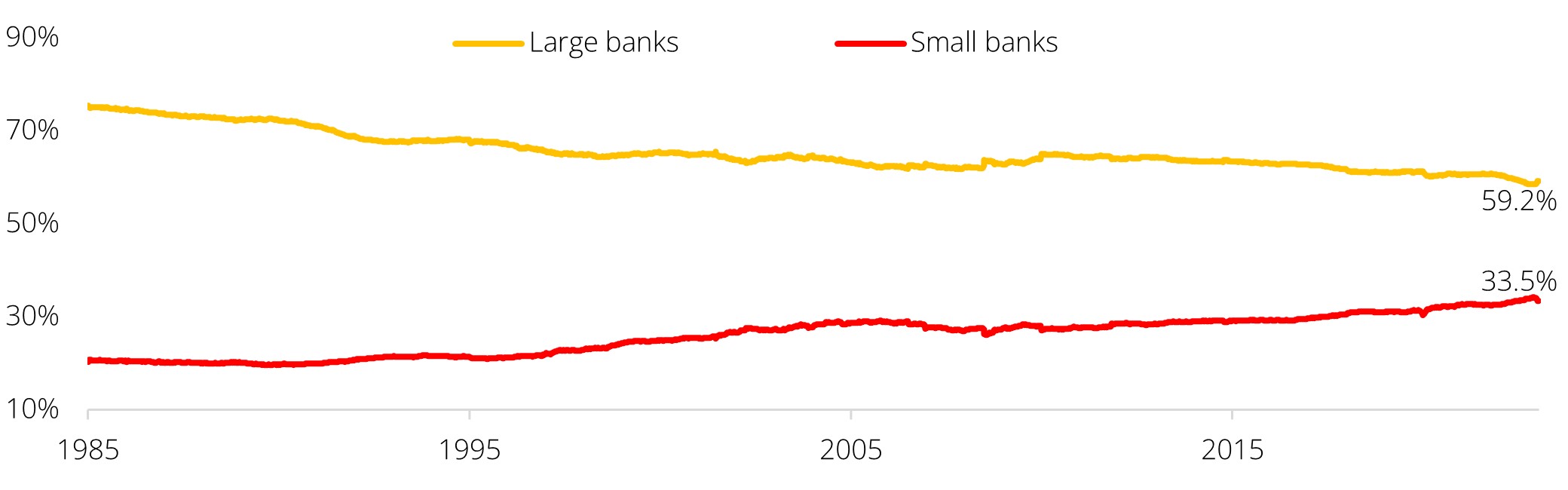

- According to the St. Louis Federal Reserve, the percentage of total bank credit attributable to small domestically chartered banks (defined as all domestically chartered banks outside the top 25 by asset size) has grown over time, from c.20.4% in 1985 to 33.5% as at Apr-2023.

- US small bank loans to the CRE sector account for c.7% of US GDP and this is significantly above residential real estate (c.3.4%) as well as other commercial and industrial loans (c.3.0%).

- With small banks accounting for a third of total bank credit in the country, a tightening in lending conditions or even a liquidity freeze from these banks would therefore significantly impact the wider economy.

Figure 1: Small banks as % of total bank credit is on the rise

Source: Bloomberg, St Louis Fed, DBS

Question 2: Will this be a repeat of 2008’s Great Financial Crisis (GFC)?

- Comparing the situation today with 2008, we believe that the probability of a GFC redux is low given that banks today are much better capitalised.

- A widely used gauge for banks’ financial health is the tangible common equity to risk-weighted assets (TCE/RWA) ratio. In the run-up to the GFC of 2008, the TCE/RWA ratio for US large banks (proxied by JPMorgan Chase, Citigroup, and Bank of America) deteriorated from 6.3% in Dec-2006 to 4.4% by Jun-2008 (right before the crisis).

- Banks operating on low TCE/RWA ratios run the risk of having their shareholders’ equity wiped out should liabilities spike, leading to insolvency. But post-GFC, banks’ equity position underwent a sea change. Average TCE/RWA ratio has improved markedly to 13.0% (as of Mar-2023), putting these banks in a better position to weather future shocks.

- Besides, US large banks no longer have the same outsized exposure to CRE and henceforth, they can continue to provide liquidity and funding to the economy should the former implode.

Question 3: What is the impact on global risk assets?

- The impact on equities, credit, rates, FX, and private assets can be found in the full report.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.