- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

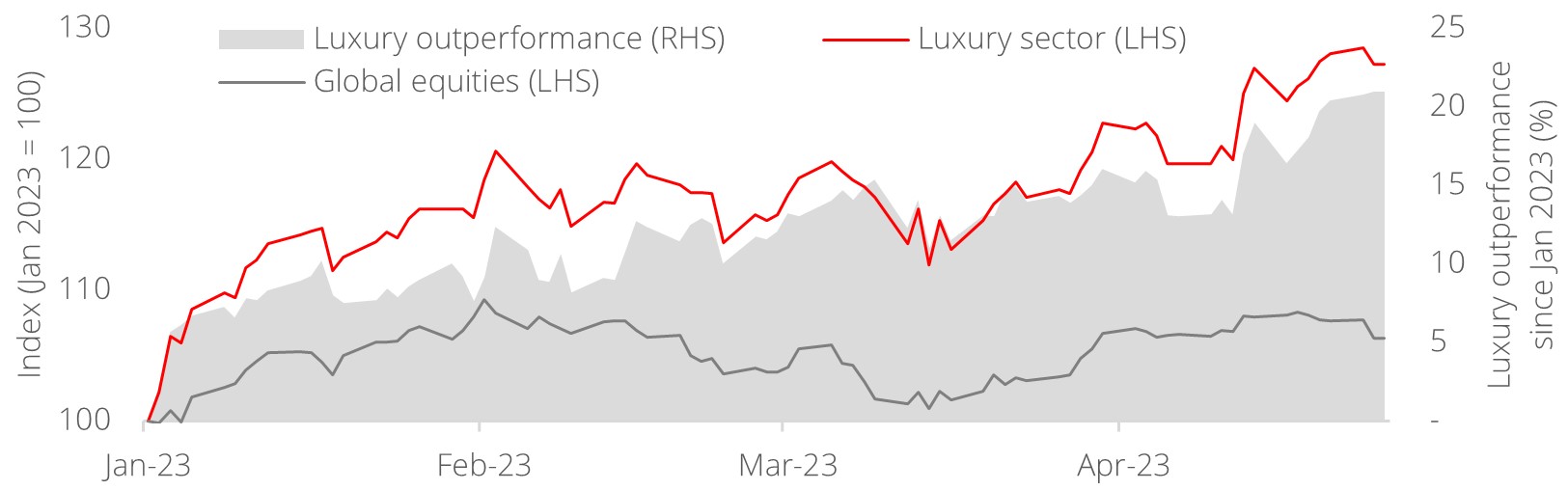

- The luxury sector pulls ahead of other global equities by more than 20% YTD

- Luxury leaders show strong performance driven by revenue growth in Europe and Asia

- Growth in Chinese spending abroad could offset impact of US slowdown

- Most high-end, exclusive brands are favoured, with expected resilience in looming economic slowdown

Related Insights

Sectoral call on luxury playing out as high-end spending remains resilient. On the back of secular trends of rising affluence and consumerism, we had earlier identified the global luxury goods sector as a winner for the 21st century. Today, although dampening consumption, growth headwinds and economic challenges cloud the near-term horizon, this has not dulled the sector’s outlook. In fact, this challenging climate has allowed leading brands to distinguish their performance as evidenced through their brand loyalty, superior pricing power, and resilient demand through economic cycles.

Indeed, the luxury sector has widened its lead in a macroeconomic environment that has otherwise proven challenging for investors. To illustrate, the European luxury index widened its outperformance over global equities by more than 20% year-to-date (YTD), with luxury powerhouse LVMH making headlines by becoming the first European company to break USD500b in market capitalisation. Other luxury bellwethers have also displayed outstanding performance, driven by strong sales especially in Europe and Asia.

Risks to the sector include a slowdown in consumption given the challenging macro environment, especially in the US. There are also uncertainties regarding sentiment in China as the society emerges from months of prolonged, stringent lockdowns. Nonetheless, we remain optimistic regarding the gradual return of Chinese tourists to global luxury retail and China’s continued role as the world’s consumption engine. Furthermore, should a slowdown ensue, the most established brands catering to the most exclusive echelons of consumers are generally insulated and able to best defend their margins, boding well for the owners of top brands. On the flipside, companies concentrated on specific brands which are still subject to execution risk could face challenges.

We reiterate our strategy to focus on high quality companies. The outperformance of the sector has been backed by strong organic sales growth, demonstrating the ability of distinguished brands to entice consumers through economic cycles. Stay with industry leaders given brand polarisation that favours the most established, exclusive brands.

Figure 1: Luxury sector widening its lead since the start of 2023

Source: Bloomberg, DBS

Download the PDF to read the report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.