- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Policymakers pivot to ease rules for China's new economy sector to support its development

- China tech sector recovered some 20% after hitting bottom in Oct 2022

- Earnings quality of sector leaders have remained resilient despite Covid headwinds

- Announcements by top govt officials confirm the easing of policy crackdown on platform companies

- China's new economy sector preferred as growth booster in the CIO Barbell Strategy

Government easing policy on New Economy Sector. After some 20 months of policy crackdown on the new economy sector, China’s regulators have pivoted to easing the rules in a bid to support the development of this colossal and strategically important sector.

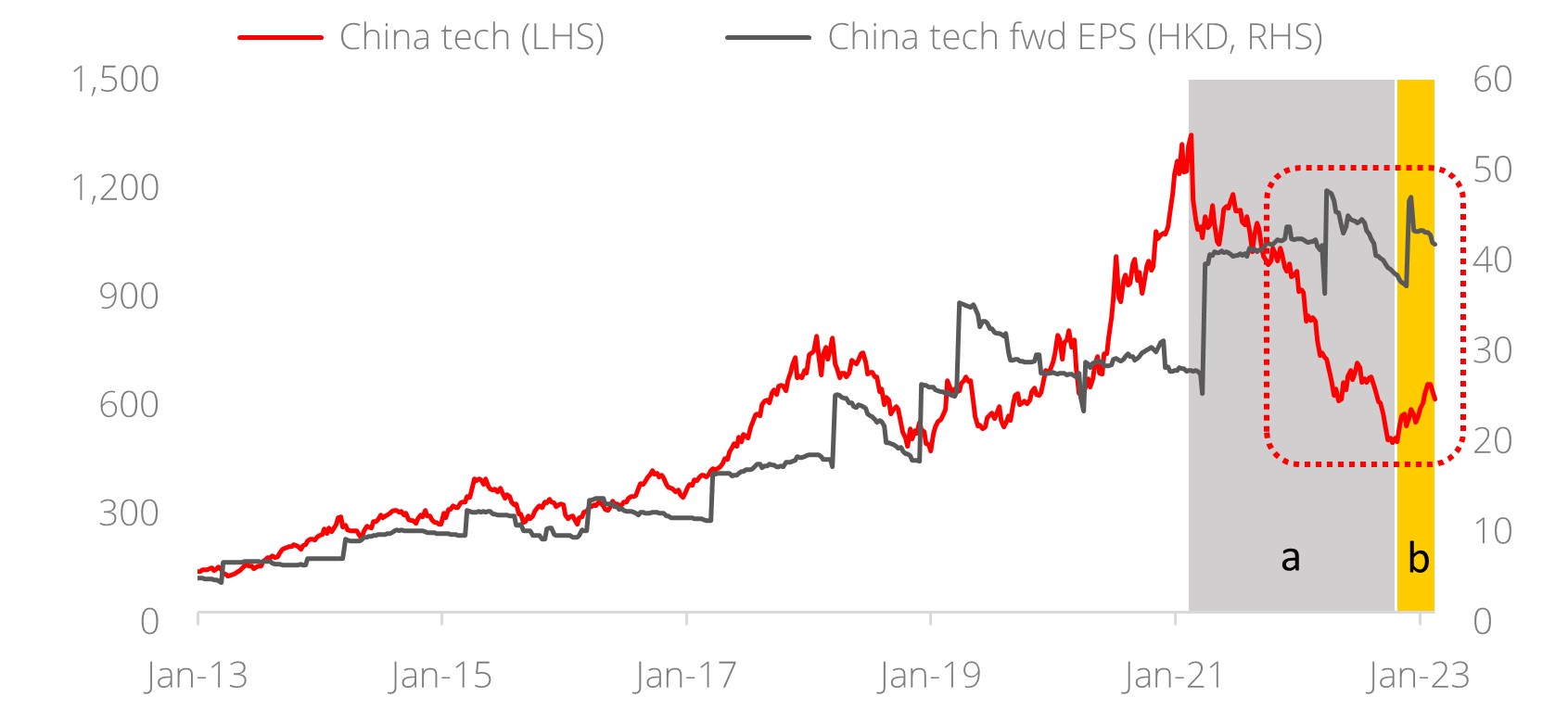

Since the start of strict policy implementation, China’s technology equities plummeted some 60% between February 2021 and October 2022 (Figure 1, period a) as investors bailed out of their exposures. This resulted in an obvious divergence where stock prices corrected in spite of resilient earnings.

Post China’s Party Congress, things took a decisive turn for the better when policymakers started to pivot from their previous policy stance and introduced a series of supportive measures for the sector, which was in line with our expectations.

Subsequently, China equities and China’s technology sector in particular, saw an encouraging recovery and the latter’s stock prices rebounded some 20% since the end of October (Figure 1, period b). This comes on the back of encouraging developments, namely easing of policies, senior officials expressing support for Internet firms, and an announcement of material plans to revive growth of the digital industry.

Figure 1: China Technology - divergence in stock prices and earnings forecast unjustified

Source: Bloomberg, DBS

Importantly, throughout the past two years, fundamentals of China’s new economy sector have remained resilient notwithstanding the Covid lockdowns, policy tightening, and headwinds confronting domestic consumption. Looking at five listed new economy firms which have at least 10 years of listing record, on aggregate, their revenue and profitability have proven to be resilient even during the pandemic. Now, with policy tightening in the rearview mirror, we anticipate the sector will shine again.

Existing investors are well-positioned to benefit from this recovery, while investors not yet exposed to this sector should seize this window of opportunity to capture its upside potential.

Tailwinds from policy support. Senior policymakers from high-level government agencies have openly expressed their stance in the past few weeks to support the success of China’s digital economy and companies operating around the eco-system.

Ripe for rerating. We expect China technology and new economy sectors to bottom at current levels and recover, catalysed by the following:

- Forward PER of the technology sector is at a multi-year low and hovering at -2 standard deviations to mean. This is unjustified given the double-digit forward earnings growth among bellwether new economy companies.

- Price-to-book at -1.5 standard deviation to mean, similarly at a multi-year low.

- Close inverse correlation with US bond yields. With most of the US rate hike cycle largely priced in, the sector should find a bottom at this level, paving the way for a longer lasting rerating.

Recommendations. Amid this compelling backdrop, improvement in the operating environment, emergence of new regulatory support, and favourable risk-reward tilt, China’s new economy sector is among the preferred expressions as growth boosters in the CIO Barbell Strategy.

To view more takeaways and our full analysis, please download the PDF to read the full report

Topic

Explore more

CIO PerspectivesThis information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.