- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- PBOC latest central bank to accelerate gold purchases amid geopolitical uncertainty

- Gold hits nine-month high in Feb on softer dollar but traces back gains as disinflation picks up

- On balance, gold prices remain well supported by long-term tailwinds

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

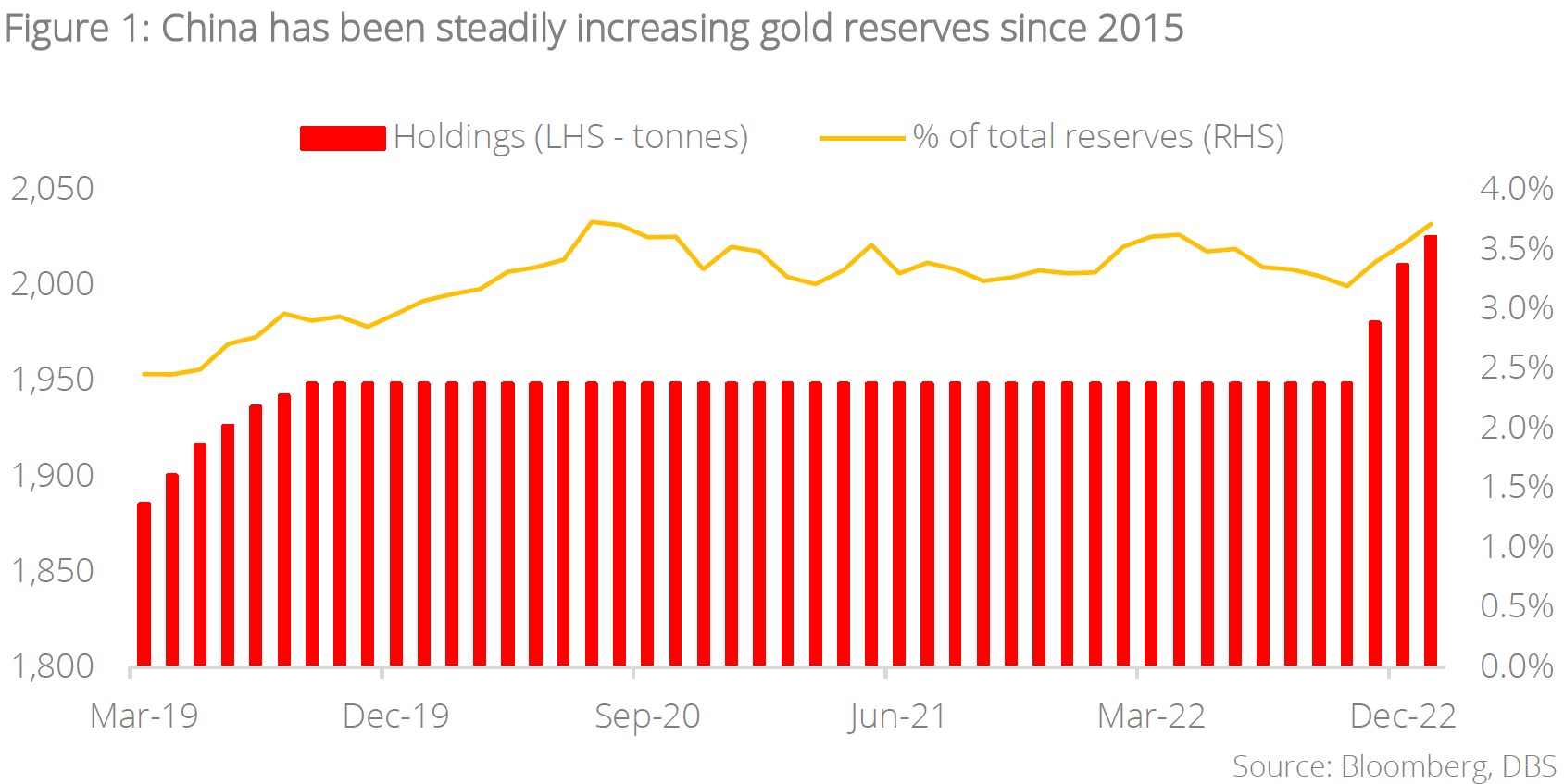

PBOC announced another increase in its gold reserves in January. China joins the list of countries that are stocking up on the precious yellow metal, with the People’s Bank of China (PBOC) announcing yet another increase in its gold reserves in January, this time by 15 tonnes. Its total gold reserves currently sit at 2,025 tonnes, which is an all-time high. This trend of increasing central bank buying has been going on since the second half of last year, with buying peaking in 3Q22 at a record high level of 400 tonnes. The motivation for this is multi-fold, but one of the key reasons is undoubtedly to de-risk vis-à-vis the dollar and dollar assets in favour of a more ‘neutral’ store of value that is not cuffed to any individual economy and has the added benefit of being resilient in the face of geopolitical and financial crises.

With gold already quoted in yuan and China having its own gold exchange in the form of the Shanghai Gold Price Benchmark, it is reasonable to believe that there are ambitions to create a ‘gold yuan’, similar to how it has been pursuing the petro-yuan. Furthermore, with gold accounting for only 3.7% of the country’s FX reserves (Figure 1), China will have plenty of ammunition for further gold purchases in the future should it want to extend its gold buying streak. Together with China, countries that have been hoarding gold in recent quarters such as Turkey and Kazakhstan, should continue to provide support for gold from a fundamental demand perspective.

For now, gold will remain largely driven by the dollar. Gold carried its strong performance from the last quarter of 2022 into the new year, hitting a nine-month high of USD1,950 on 1 February 2023. This stellar run was largely on the back of a weakening dollar, which bolstered safe haven demand for the precious metal, and strong central bank buying over the past two quarters. Following this rally however, gold price pulled back sharply after a spectacular jobs report for January, which saw the US economy add 517,000 new jobs (vs. estimates 189,000), and higher-than-expected inflation of 6.4% (vs. estimates 6.2%). This series of macroeconomic data print releases derailed hopes of a dovish pivot by the Fed for the near/medium term and re-materialised support for the dollar and treasury yields.

Long-term constructive on gold. Headwinds aside, we remain constructive on gold on balance given the favourable conditions, including the softening dollar and expectations of a less-aggressive US rate trajectory this year compared to 2022. Structural trends favouring central bank buying should also prove supportive of gold prices in the longer run.

Additionally, we continue to advocate for gold as a risk diversifier, given its low correlation with bonds and equities, in a holistic and balanced portfolio. Gold has also demonstrated resilience during past financial crises, so holding gold will add overall resilience against black swan events. Investors can gain exposure to gold via the following expressions: i) physical gold; ii) gold futures; iii) ETFs and managed funds on physical gold and gold mining equities; or iv) direct holdings in gold mining equities, which are essentially a leveraged expression of gold.

To view more takeaways and our full analysis, please download the PDF to read the full reportTopic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024