- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Investors need not be unduly perturbed by US debt ceiling impasse

- Holding the world's reserve currency allows the US to finance its debt by printing any shortfall

- Investors may wish to complement "risk-free" govt debt with low-risk IG corporates

- Fiscal prudence could ease US inflation and lower the interest rate trajectory

- These would be tailwinds for high quality bonds

Related Insights

Here we go again. The issue of the ever-expanding US debt situation has once again come to the fore with the current cap of USD31.4t proving insufficient for the nation’s spending needs. While this debt ceiling has at times been raised or suspended without much fanfare, it becomes trickier under a divided Congress; in this instance the House Republicans are leveraging on this impasse to extract major spending cuts from the Democrats in the name of fiscal prudence.

Been there done that. At this point, investors should no longer be unduly perturbed by the sabre-rattling of politicians. Yes, should the government not be able to borrow more funds, there would be several businesses and households that would be unable to pay their bills while awaiting government receivables. Budgets of local governments could be strained. Large spending drops could see an economy accelerate towards recession and high unemployment, roiling financial markets in its wake.

However, the truth is that ever since the debt ceiling was enacted in 1917, subsequent “crises” of a debt ceiling imbroglio have come and gone – specifically, 78 times since 1960 – with the same results of (a) the limit being suspended or raised, while (b) the US government becoming ever more indebted when the new limits are breached again. We have alluded to this dynamic of an ever-diminishing debt sustainability issue by illustrating that after accounting for mandatory spending items like defense and social security, the US collects only just enough in tax receipts to service interest on its debt. As such, principal repayments will continue to be a recurring problem in the future.

Risk free rate is risky. In 2011, the US got so close to default that its credit rating got downgraded by the credit rating agency S&P, citing risk of default caused by “political brinkmanship”. Ironically, US treasury bonds rallied in its aftermath as investors flocked to “safety” as a Pavlovian response, perhaps not recognising that this safe haven was increasingly exhibiting more cracks.

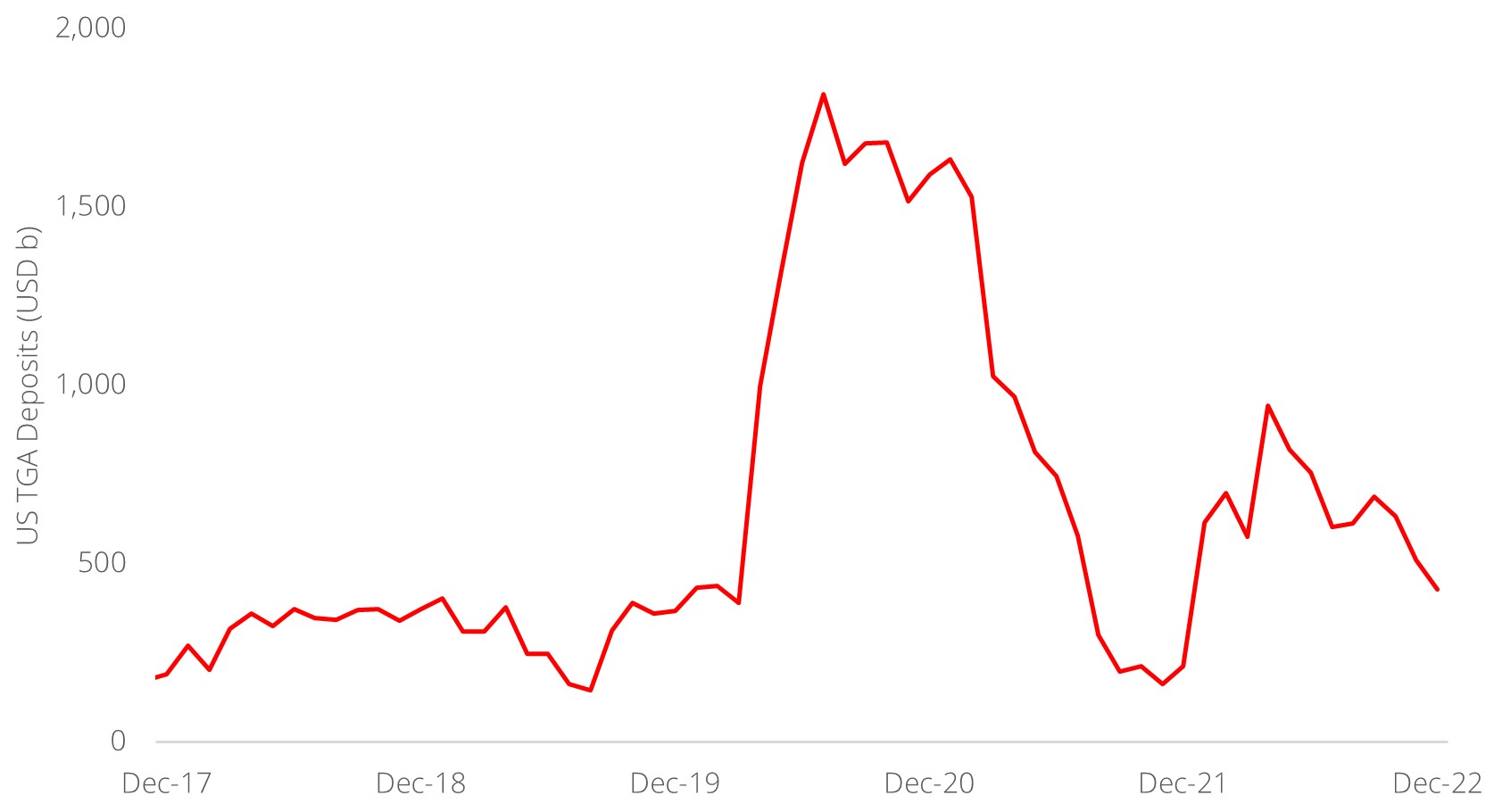

Such is the exorbitant privilege of holding the world’s reserve currency – the US would always be able to print the difference should there be a shortfall of lenders to finance their ever-growing debt. For now, there is some comfort that they still hold c.USD330b in their Treasury General Account (TGA); funds that they can tap on while Congress negotiates new limits. One can think of the TGA as excess funds in a current account that one can utilise when their credit card and other borrowing limits have been maxed out, and the US does still have some funds saved for rainy days such as these.

US TGA still contains excess funds for a rainy day

Source: Bloomberg, DBS

Stay with quality credit. Given these developments, investors may wish to include exposure to low risk, investment grade credit issuers to complement their holdings in “risk-free” government debt as part of an overall fixed income portfolio. Investment Grade corporates are, after all, rated well because of strong balance sheets and interest serviceability, the same of which we cannot say of certain sovereign issuers.

Additionally, a shift in congressional discussions towards more fiscal prudence could be positive in the US’s fight against inflation, taking pressure off the Fed and its monetary policy from being the only tool to slow an overheating economy. Should rates continue a lower trajectory, this would present a further tailwind for high-quality bonds down the road.

Download the PDF to read the full report

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.