- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Gold hits 8-month high on softer dollar and moderating wage growth in the US

- Uptick in central bank buying looks set to continue due to dollar-related & geopolitical factors

- Positive real rates cap upside for the yellow metal

- Moderating inflation also limit future relevance of an inflation hedge

- Gold prices remain well-supported; gold remains key aspect in holistic portfolio as risk diversifier

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

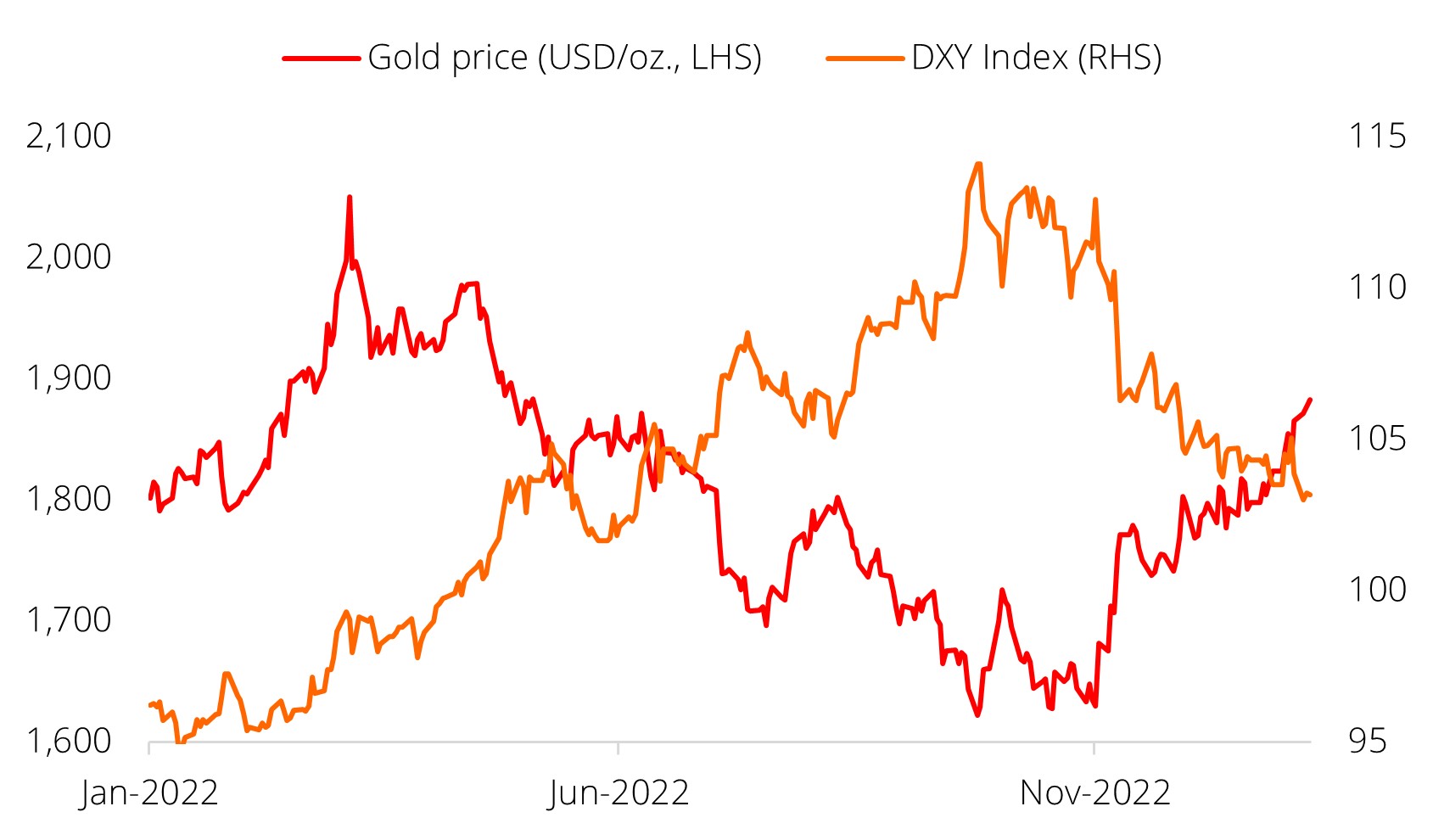

Dual catalysts of softening dollar and cooling economy. Gold carried its strong performance from the last quarter of 2022 into the new year, hitting an eight-month high on the back of: i) a weakening dollar and ii) positive US macroeconomic data in the form of moderating wage-growth data. A weaker dollar contributes positively to gold prices as it increases demand from overseas buyers of dollar-priced bullion. Additionally, it shifts some safe haven demand from the greenback back to gold. On the macroeconomic front, non-farm payroll data came back stronger than expected for the month of December, but the silver lining is that wage growth is moderating, suggesting that the cumulative rate hikes by the Federal Reserve in 2022 are indeed working their way through and slowing the economy. This in turn stoked investor hopes of a less aggressive rate hike trajectory, and lifted sentiment around bullion, which closed at USD1,883/oz on 11 January, marking a 15.5% increase from recent lows in November.

Gold price continues to climb as dollar weakens

Source: Bloomberg, DBS

Central bank buying to support gold prices. Central bank buying has picked up in the past two quarters, notably hitting a record high of 400 tonnes in 3Q22. This trend looks set to continue with the dollar looking likely to further weaken in 2023. The US typically leads global rate hiking cycles, and this time is no exception; while other countries have just begun or are in the thick of hiking rates, the Fed has already hiked a mammoth 425 bps thus far and will likely look to slow its pace of rate hikes moving forward. This means that interest rate differential among countries will diminish over time and the dollar will likely weaken vis-à-vis other currencies. From the perspective of central banks, buying gold is a way to derisk against the dollar and dollar assets, in favour of a more “neutral” store of value that has relative immunity against geopolitical and financial crises, and is not cuffed to any individual economy. Another reason for central banks to continue buying gold is that it provides a medium of exchange (albeit a primitive one) that is independent of the largely dollar-based international system of payments. With widespread sanctions imposed by the European Union and other western countries against Russia (including the SWIFT ban), countries that traditionally have had strong business ties with the former, such as Turkey and Kazakhstan, have increased their gold buying activity in recent quarters to this end.

Upside capped by positive real rates and moderating inflation. Notwithstanding the recent price rally and demand tailwinds, gold prices are likely to be capped on the upside by positive real rates. As central banks around the world press on with monetary tightening, the days of zero interest seem to be all but firmly behind us. Inflation, while still high in many regions, also looks to be slowing, which will further contribute to rising real rates. This phenomenon will invariably reduce the attractiveness of gold. The extent of the price impact, however, is yet to be determined. Gold’s role as an inflation hedge may also gradually diminish in importance when CPI numbers eventually moderate to lower levels.

Remain constructive on gold but be cognisant of headwinds. Headwinds aside, we remain constructive on gold on balance given the favourable conditions, including the softening dollar and expectations of a less-aggressive US rate trajectory moving forward. Structural trends favouring central bank buying should also prove supportive of gold prices in the longer run. Additionally, we continue to advocate for gold as a portfolio risk diversifier given its low correlation with bonds and equities, in a holistic and balanced portfolio. Investors can gain exposure to gold via the following expressions: i) physical gold; ii) gold futures; iii) exchange-traded funds and managed funds on physical gold and gold mining equities; or iv) direct holdings in gold mining equities, which are essentially a leveraged expression of gold.

Download the PDF to read the full analysis.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024