- Risk-off events turbo-charged gains for gold; gold prices reached high of USD2,040/oz. in Apr

- Beyond fear driven rally, growth and inflation risks underscore the outperformance of gold in April

- Central bank buying, ETF flows, and retail investor demand to further support future gold prices

- Upgrade target price from USD1,950/oz. to USD2,050/oz

Related Insights

Risk off, fear on; the outlook for gold improves. Gold price breached the key USD2000/oz. price in April, driven by a flight to safety on the back of two global risk events: i) banking collapses in US and Europe, and ii) surprise production cuts by OPEC+ amounting to 1.15mmbpd. But beyond a fear-driven spike in demand, we believe that these events have also impacted gold demand in a more fundamental and lasting way.

The banking sector debacle for example is set to benefit gold demand through a more benign interest rate outlook; with the Fed now forced to balance financial market stability with its two existing mandates, it will likely have to abandon plans to further aggressive hiking, which will in turn weaken the dollar and keep a lid on treasury yields in the long run.

On the other hand, the surprise cuts by OPEC+ further cemented the likelihood of future scenarios dominated by either sticky inflation or mounting recession risks, both of which are favourable for gold, which is seen as both a safe haven asset and inflation hedge. Put simply, these recent developments have had a double-barreled positive impact on gold, skewing its return to the upside. Heightened fear stoked short-medium term inflows while a moderating rate/dollar outlook, rising growth risks, and sticky inflation bolstered the long-term demand outlook for the precious metal. Against this backdrop, we upgrade our outlook for gold and lift the target price from USD1,950/oz. to USD2,050/oz.

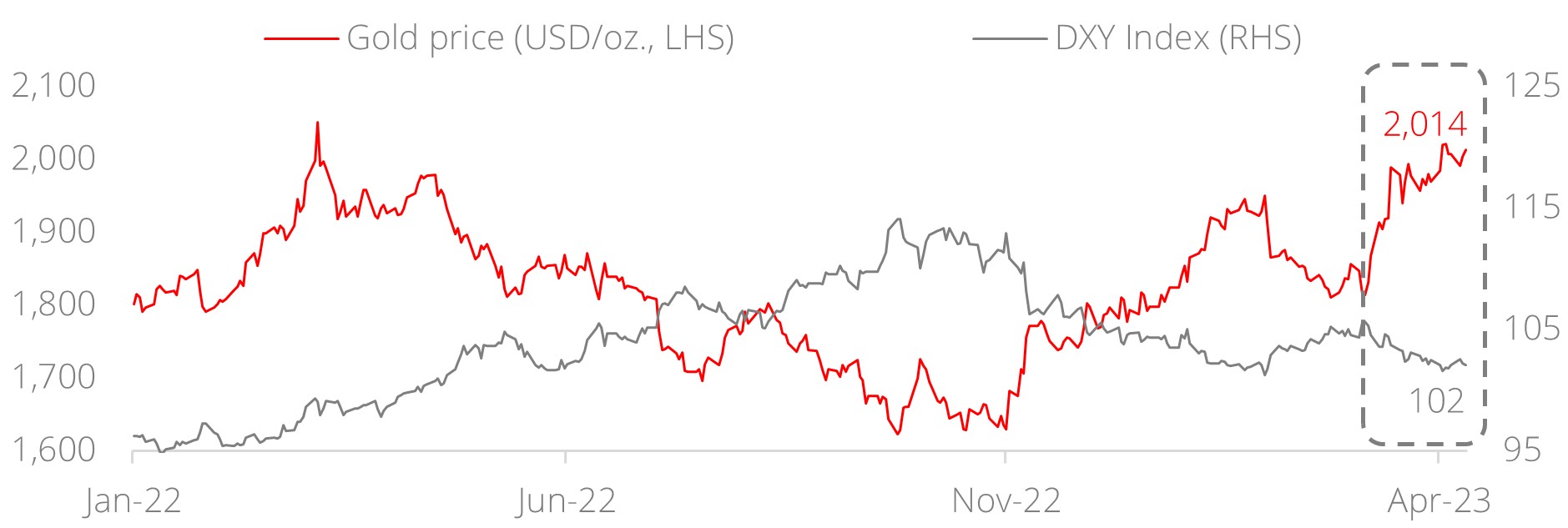

Dollar correlation holds. We mentioned in our quarterly CIO insights that gold price is very much dollar driven, and this has not changed. In January, the prospects of a US soft-landing and led to a softening dollar, which fueled a month of strong performance for gold. In February however, a spate of overly strong US macroeconomic data quickly changed the rate narrative to “higher for longer” and reversed much of the gains from the previous month.

Now, in the wake of Silicon Valley Bank’s (SVB) collapse, the rate and dollar outlook has once again shifted to one that incorporates rate cuts happening sooner rather than later. Since the crisis, the terminal rate pricing has been shaved by some 75-100 bps, and additionally, the market is now pricing in about 70 bps of cuts (from peak) by the end of the year and a cumulative 200 bps of cuts by end-2024. This rate outlook has sent the dollar on a steady decline since mid-March, while gold conversely rallied to a high of USD2,040/oz. on 13 April. Should there be further tremors in the banking sector, rate cuts could materialise, spelling further upside for gold this year.

Figure 1: Gold price rallied as risk events took centre stage and dollar weakened in March

Source: Bloomberg, DBS

Recession or inflation? Gold wins either way. While the banking crisis has so far been quite well-contained thanks to supportive policies from regulators, it does not change the fact that interest rates, at their current level, are impacting the real economy and nudging it closer to recession. The probability of recession has since risen from less than 10% in June 2022 to 60% as at the end of March this year. In an unlikely scenario where the US economy manages to stave off recession, the inference is that the inflation rate would remain elevated. Gold will still be a beneficiary as historical trends have pointed to gold as a good inflation hedge.

Other tailwinds wait in the hangar. Notwithstanding the latest price rally, we believe that there are further tailwinds for gold that have yet to be priced in. Among those are: i) growing central bank buying on the back of geopolitical reasons; ii) ETF flows, which have been largely missing from the most recent gold rally; iii) other forms of speculative buying in gold and gold derivatives; and iv) retail investor demand for gold. Even if gold’s current price has adequately priced in the current state of heightened market fear and growing recession risks (which we do not believe has been done), each of these factors represent further catalysts for positive price action for gold in the future.

Upgrade outlook for gold with target price of USD2,050/oz. Primary tailwinds for this upgrade are the sharp rise in recession probability; in our model we have used an 80% chance of US recession as a key assumption to arrive at our target price. We also expect: i) headline CPI at 5.0%; ii) DXY Index to weaken further to the 95-100 range, and 10Y US treasury yields to be between 3.0 – 3.5% for our target price to materialise. As mentioned, further upside price risks exist should the Fed decide to implement rate cuts in 2H. In such a scenario, a further revision of our target price will be warranted. For gold prices to push sustainably above USD2,050/oz., an unexpected and significant change in outlook for either inflation, treasury yields, the dollar or recession probability will have to take place.

Download the PDF to read the report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

Related Insights

DISCLAIMER