Supply Chain Financing | Trade Products | DBS SME Banking Indonesia

- Trade

- Related Services

- Supply-Chain Financing

Supply-Chain Financing

Free up working capital in your supply chain

- Trade

- Related Services

- Supply-Chain Financing

Supply-Chain Financing

Free up working capital in your supply chain

At a Glance

Free up valuable cash trapped in the supply chain with DBS Supply-Chain Financing (SCF). This innovative working capital solution benefits all parties involved by leveraging our relationship with a corporate anchor to inject liquidity into the supply chain.

Improve working capital

Improves your working capital

Competitive

Enjoy competitive interest rates

Security

No additional security required

How it Works

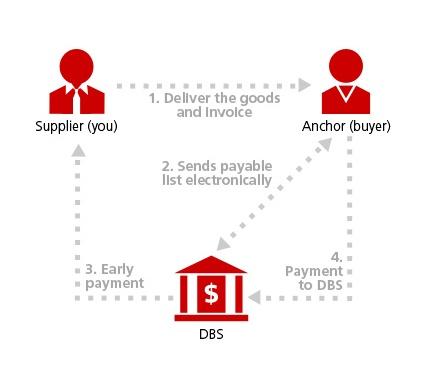

We finance sales to corporate buyers by accessing invoice information directly from buyers who have signed an agreement with us:

- As the supplier, you deliver the goods and invoice to your buyer

- On a pre-agreed date, your buyer sends us his/her payables listings (invoices and credit/debit notes)

- We then pay you early

- We collect payment from your buyer on the invoice due date

Fees & Eligible

Benefit from DBS’ experience as a pioneer in supply-chain solutions.

- Reduce paper transactions with automated processing.

- Contact your Relationship Manager for confirmation rate.

FAQs

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?