JALANI CERDIKMU

with digibank by DBS

Life is about making clever choices.

With digibank,

you can always explore various clever ways to make the most of today while preparing for the future, all in 1 App.

Whatever your profession or lifestyle,

now you can handle various challenges more cleverly with the right support system.

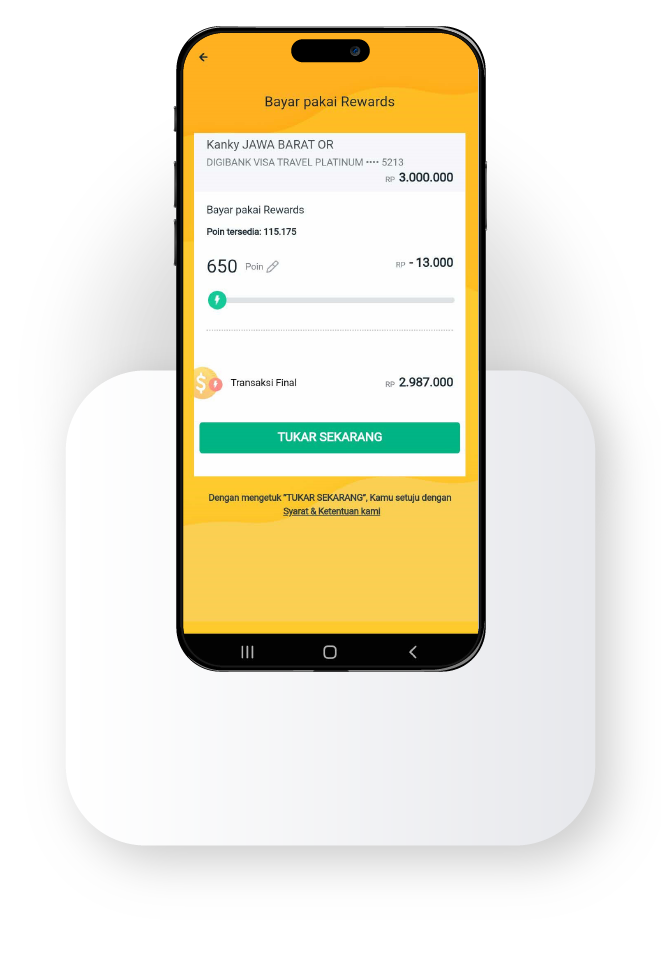

Make the

Most of Today

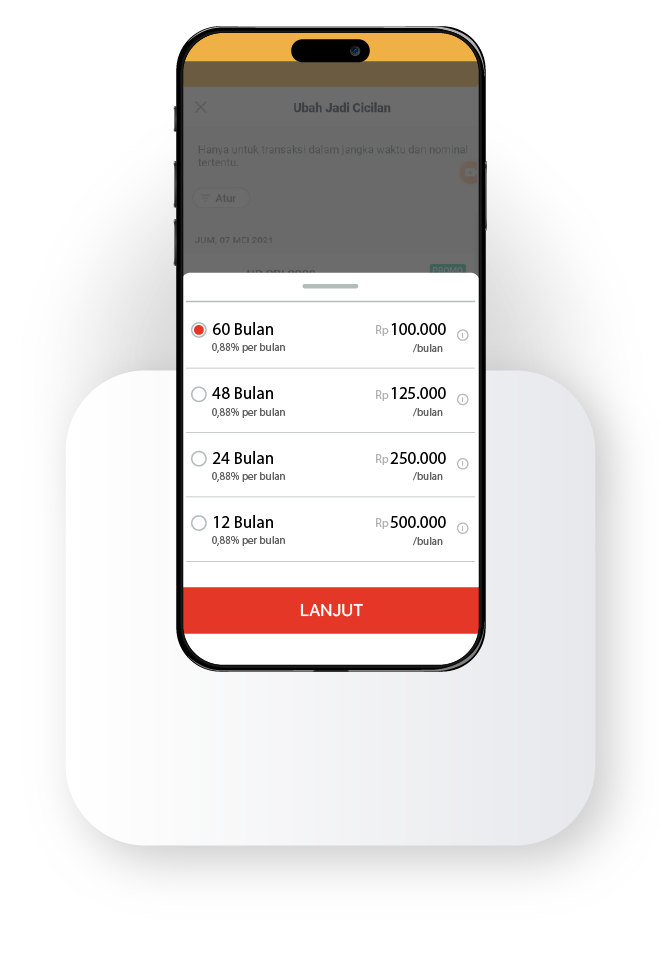

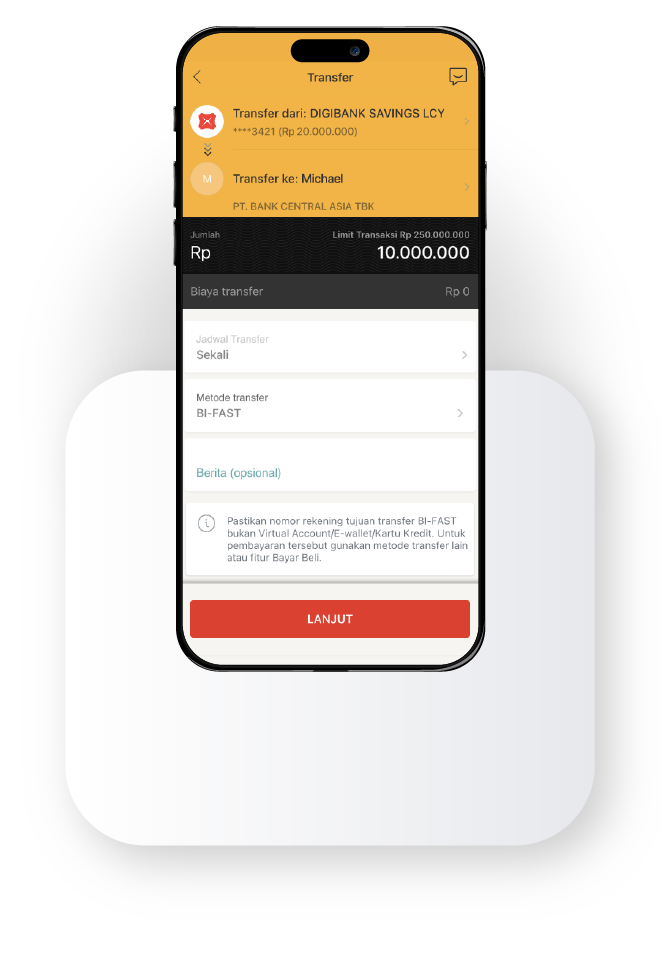

Maximize the joy of now with no hesitation with clever way for an all-out life!

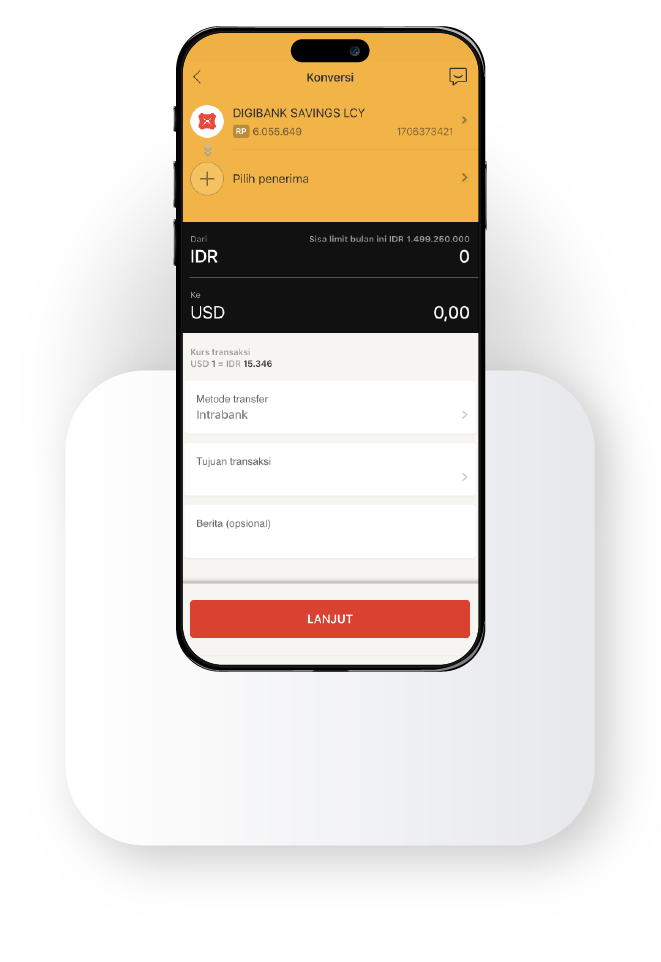

Navigating Tomorrow

Keep having fun without worrying about your future!

Always With Ease

Manage Your Finances in a Clever Way

Sneak a Clever Ways

to Use digibank

digibank by DBS

has been recognized by many as

the best bank

Your trust has motivated us to persist in our commitment and innovation.

Let's take a look at the

clever way in their version.

Stay All Out with

latest update

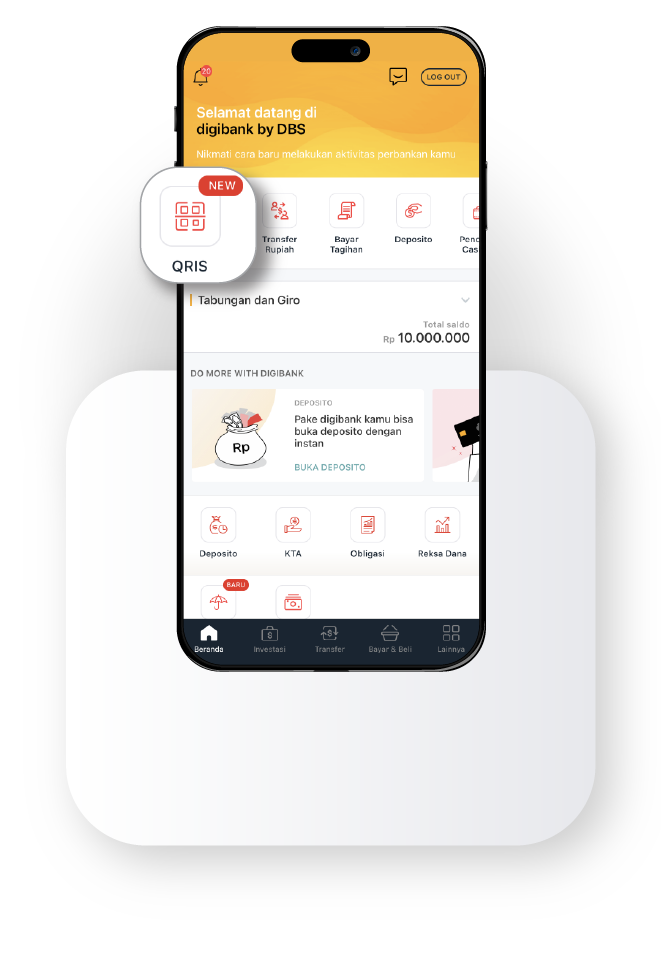

Semua bisa

kamu lakukan

di 1

Aplikasi

Follow Us on Social Media

Buat keseruan dan cara cerdik yang lebih banyak