DBS boosts DBS Multiplier benefits to better serve customers’ long-term financial needs

Singapore.01 May 2019

Bank doubles DBS Multiplier’s balance cap for bonus interest to SGD 100,000 and sets peak interest rate for balances above SGD 50,000 at 3.8% p.a.

Programme is designed to encourage financial planning and grow with customers as they progressively build wealth

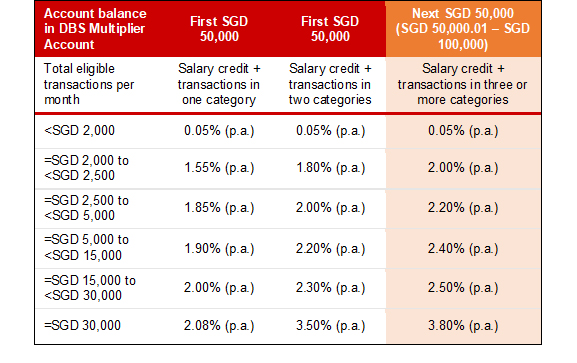

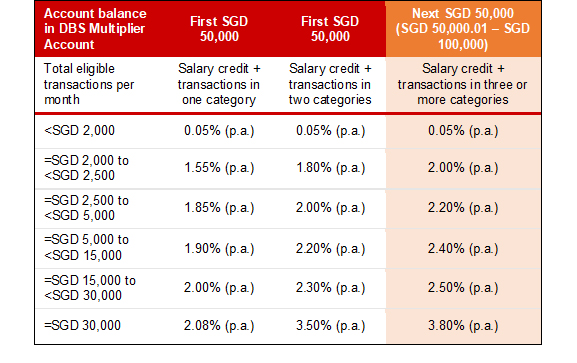

Singapore, 01 May 2019 - Starting today, the popular DBS Multiplier programme will double its balance cap for bonus interest from SGD 50,000 to SGD 100,000. In addition, DBS Multiplier’s peak bonus interest rate for balances more than SGD 50,000 will be set at 3.8% per annum, making DBS Multiplier one of the most attractive “bank-and-earn” propositions in Singapore.

The DBS Multiplier programme aims to reward consumers when they consolidate their finances with DBS/POSB. To enjoy higher interest rates on their DBS Multiplier account balances, customers simply need to credit their salaries to DBS/POSB and transact in one or more of the following categories: credit card spend, home loan instalment, insurance or investments. In late 2017, DBS Multiplier became the only programme of its kind in Singapore to have no minimum amount for salary credit or minimum credit card spend. Its unique proposition was met with overwhelming response: both DBS Multiplier customers and DBS Multiplier account balances have more than doubled since.

Said Jeremy Soo, Head of Consumer Banking Group (Singapore), DBS Bank, “With low barriers to entry, a clear and flexible proposition, as well as attractive bonus rates, we hope more consumers will take advantage of DBS Multiplier’s programme to become more proactive and engaged in their financial planning journey – to save, spend, protect and invest well. DBS Multiplier customers are steadily growing in financial savvy. Today, they are three times more likely to have insurance plans and/or investments compared to non-DBS Multiplier customers. In addition, some 40% of DBS Multiplier customers have grown their assets to beyond SGD 50,000. The latest enhancements aim to build DBS Multiplier for longevity, so we can grow with our customers and remain relevant even as their financial needs evolve.”

DBS Multiplier’s new benefits were developed through consistent engagement with over 10,000 of the programme’s customers on DBS’ Facebook community The Burrow, which provides financial literacy tips and advice to DBS Multiplier users. The Burrow also provides a space for community members to interact and learn from each other.

New DBS Multiplier benefits for balances above SGD 50,000

To enjoy bonus interest rates on DBS Multiplier account balances above SGD 50,000, customers need to credit their salaries to DBS/POSB and transact in three categories[1]. Benefits for balances up to SGD 50,000 remain unchanged. Eligible transactions are automatically detected by the bank across the DBS/POSB products held by customers, which means customers only need to deposit their funds in a DBS Multiplier account, while transacting with their usual DBS/POSB accounts to enjoy the higher interest rates.

The following scenarios illustrate how DBS Multiplier can apply to customers across different life stages:

Scenario 1 – New-to-workforce graduate

[1] Comprising any combination of the following categories: credit card spend, home loan instalment, insurance or investments

[2] Source: 2018 Joint Graduate Employment Survey, link

[3] Source: Ministry of Manpower, link

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for ten consecutive years from 2009 to 2018.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. The bank acknowledges the passion, commitment and can-do spirit in all of our 26,000 staff, representing over 40 nationalities. For more information, please visit www.dbs.com.

The DBS Multiplier programme aims to reward consumers when they consolidate their finances with DBS/POSB. To enjoy higher interest rates on their DBS Multiplier account balances, customers simply need to credit their salaries to DBS/POSB and transact in one or more of the following categories: credit card spend, home loan instalment, insurance or investments. In late 2017, DBS Multiplier became the only programme of its kind in Singapore to have no minimum amount for salary credit or minimum credit card spend. Its unique proposition was met with overwhelming response: both DBS Multiplier customers and DBS Multiplier account balances have more than doubled since.

Said Jeremy Soo, Head of Consumer Banking Group (Singapore), DBS Bank, “With low barriers to entry, a clear and flexible proposition, as well as attractive bonus rates, we hope more consumers will take advantage of DBS Multiplier’s programme to become more proactive and engaged in their financial planning journey – to save, spend, protect and invest well. DBS Multiplier customers are steadily growing in financial savvy. Today, they are three times more likely to have insurance plans and/or investments compared to non-DBS Multiplier customers. In addition, some 40% of DBS Multiplier customers have grown their assets to beyond SGD 50,000. The latest enhancements aim to build DBS Multiplier for longevity, so we can grow with our customers and remain relevant even as their financial needs evolve.”

DBS Multiplier’s new benefits were developed through consistent engagement with over 10,000 of the programme’s customers on DBS’ Facebook community The Burrow, which provides financial literacy tips and advice to DBS Multiplier users. The Burrow also provides a space for community members to interact and learn from each other.

New DBS Multiplier benefits for balances above SGD 50,000

To enjoy bonus interest rates on DBS Multiplier account balances above SGD 50,000, customers need to credit their salaries to DBS/POSB and transact in three categories[1]. Benefits for balances up to SGD 50,000 remain unchanged. Eligible transactions are automatically detected by the bank across the DBS/POSB products held by customers, which means customers only need to deposit their funds in a DBS Multiplier account, while transacting with their usual DBS/POSB accounts to enjoy the higher interest rates.

The following scenarios illustrate how DBS Multiplier can apply to customers across different life stages:

Scenario 1 – New-to-workforce graduate

- Median salary credit[2]: SGD 2,800 (excluding CPF)

- Credit card spend per month: SGD 200

- Total eligible transactions: SGD 3,000

- Eligible interest rate: 1.85% p.a.

- DBS Multiplier account balance: SGD 10,000

- Annual interest earned: SGD 183

- DBS Multiplier account balance: SGD 100,000

- Median salary credit[3]: SGD 3,550 (excluding CPF)

- Credit card spend per month: SGD 800

- Investments per month: SGD 100

- Insurance per month: SGD 100

- Total eligible transactions: SGD 4,550

- Eligible interest rate: 2.00% p.a. on first SGD 50,000; 2.20% p.a. on next SGD 50,000

- DBS Multiplier account balance: SGD 100,000

- Annual interest earned: SGD 2,102

- Net salary credit: SGD 18,000

- Credit card spend per month: SGD 4,000

- Investments per month: SGD 4,000

- Insurance per month: SGD 500

- Home loan instalment: SGD 3,500

- Total eligible transactions: SGD 30,000

- Eligible interest rate: 3.50% p.a. on first SGD 50,000; 3.80% p.a. on next SGD 50,000

- DBS Multiplier account balance: SGD 100,000

- Annual interest earned: SGD 3,650

[1] Comprising any combination of the following categories: credit card spend, home loan instalment, insurance or investments

[2] Source: 2018 Joint Graduate Employment Survey, link

[3] Source: Ministry of Manpower, link

[End]

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for ten consecutive years from 2009 to 2018.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. The bank acknowledges the passion, commitment and can-do spirit in all of our 26,000 staff, representing over 40 nationalities. For more information, please visit www.dbs.com.