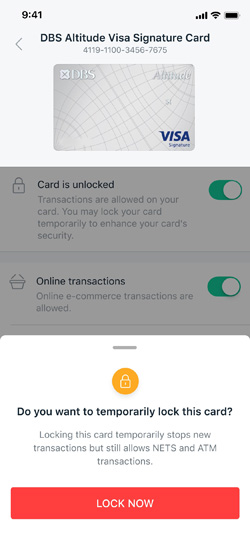

(1) Temporarily ‘lock’ or ‘unlock’ their debit or credit cards

Typically, when cardholders misplace or are unable to find their cards, they are advised to call the bank’s customer service hotline immediately to report a loss. The cards will subsequently be blocked, and a new one will be issued within three working days.

With this new temporary lock feature, customers can instead initiate an instant lock of their cards by logging into the DBS/POSB digibank app. Should customers eventually locate their ‘missing’ cards, they can then unlock the card for immediate use. This saves them the hassle of having to set up their monthly recurring bill payments and subscriptions, or even having to save their card details on file again.

This also offers convenience to customers who may wish to lock specific cards that they use infrequently, to guard against inadvertent or unauthorised usage. |  |

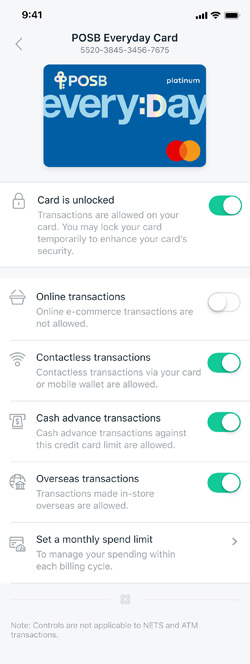

(2) Enable/disable online e-commerce transactions on all local or overseas websites

This feature will be useful for several customer profiles, such as a customer who owns several cards but only makes online purchases on a specific rewards card; or a supplementary cardholder who is not expected to shop online. It offers an additional layer of protection against unauthorised transactions, and potential fraud.

|

|

(3) Activate/deactivate usage for ‘face to face’ overseas transactions

With this feature, customers are protected from unauthorised transactions and potential fraud, especially during a time when travel opportunities are limited.

|

(4) Switch off/on the ability to make ‘contactless’ and mobile wallet payments at local and overseas merchants

While contactless card and mobile contactless payments are some of Singapore’s most preferred payment methods1, customers will now have the choice of disabling these functions according to their payment preferences.

|

(5) Enable/disable cash advance transactions on credit cards

This comes in handy for customers when they accidentally use a credit card, instead of an ATM card, to withdraw cash, which saves them from incurring a transaction fee for each cash advance transaction.

|

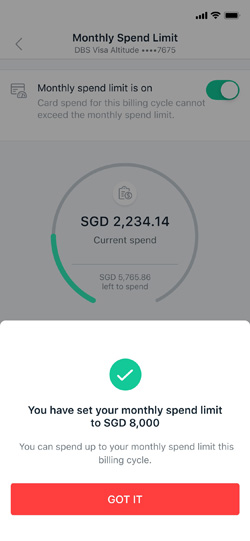

(6) Set a monthly spend limit

Cardholders can now choose to set a monthly spend limit that is lower than their credit limit, as a reminder to be prudent and spend wisely. This will also come in handy for principal cardholders to manage their supplementary card accounts. |  |