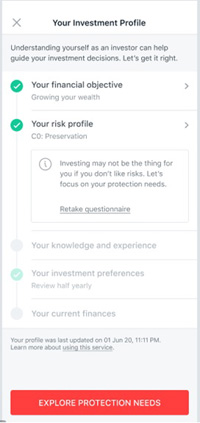

Customers will be prompted to first complete a five-question assessment in order to establish an accurate investment profile. Questions are focused on determining their financial objective(s), risk profile (which includes investment tenor and risk rating), investment preferences, and financial situation (if changes are expected in the short term).

The journey is also designed to help them complete the CKA and CAR knowledge assessments stipulated under regulatory requirements. Altogether, the process is designed to remove investment bias and guesswork for every investor. |

.jpg)

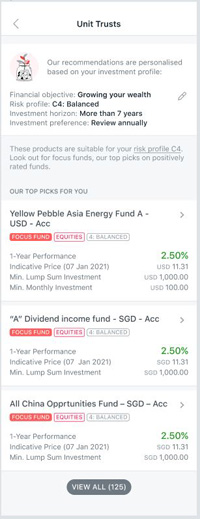

DBS’ new digital investment advisor takes a multi-dimensional approach to customer investment profiling before providing retail investors with specific recommendations

|

Once that is complete, the “Make Your Money Work Harder” digital advisor will leverage new AI/ML models to short-list and recommend specific investment solutions across six broad product product classes available to retail customers today. For a start, these products will include all Collective Investment Schemes, insurance solutions and the Asia/Global portfolios managed by DBS digiPortfolio.

Investors will also be able to filter and check their preferences – they can choose to see products which are available for CPFIS or SRS funding so that they can make their holdings in these retirement schemes work harder. |

Investment recommendations are prioritised for expert guidance; funds which are on the DBS’ Focus Funds list are displayed in higher order than the others.

|

As an additional safeguard, customers who obtain a ‘zero’ risk profile, will not receive investment recommendations. As these customers have stated that they are not willing to lose any capital, they will be advised to review insurance solutions instead.

Customers who are found by NAV Planner to have a negative cashflow will also not be able to gain access to the advisor. Instead they will be provided steps to help turn their finances around or be prompted to consolidate their holdings via SGFinDex.

Similarly, DBS/POSB customers who are aged 70 and above are advised to consult with a WPM instead (either through bank branches island-wide or virtually via TeleAdvisory) as their needs would be more complex and fluid. |

Customers who obtain a ‘zero’ risk profile being advised to review insurance solutions instead

|