| Mutual Funds | ||

| UTI Value Opportunities Fund Regular Plan Growth |

| OVERVIEW | FUND INFO | PORTFOLIO |

|

Morningstar® Category Value |

Total Net Assets (mil) 70,178.87 INR |

|

Morningstar® Benchmark S&P BSE 500 India TR INR Used throughout report |

Fund Benchmark IISL Nifty 500 TR INR |

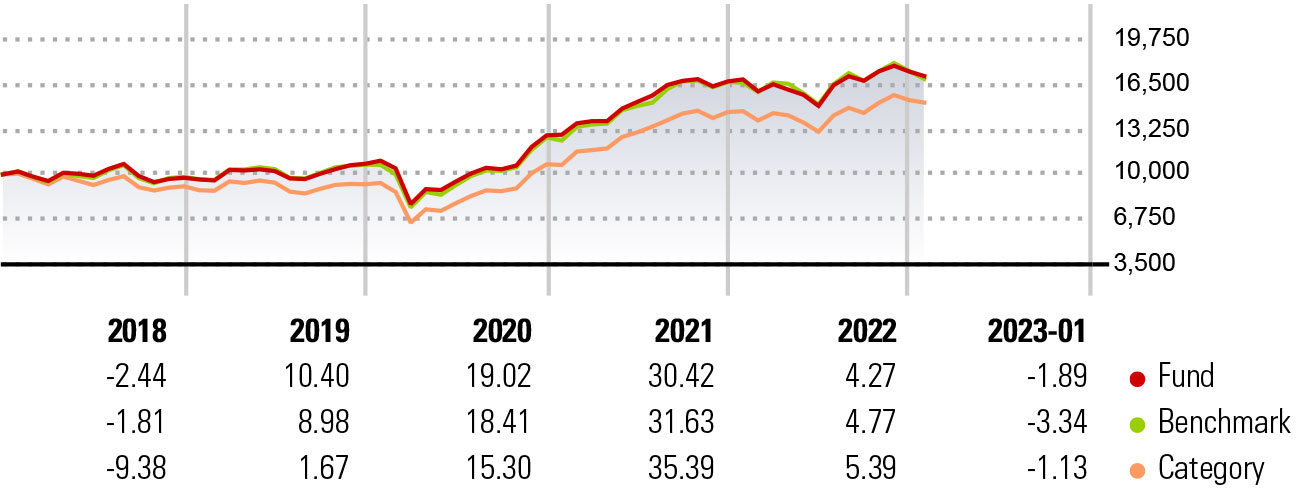

| RETURNS (%) | FUND | BENCHMARK | CATEGORY |

| 3M | -1.43 | -3.41 | 0.33 |

| 6M | 3.81 | 0.96 | 5.52 |

| 1Y | 1.03 | 0.42 | 2.87 |

| 3Y* | 16.88 | 17.37 | 19.17 |

| 5Y* | 11.61 | 11.26 | 10.53 |

| 10Y* | 12.43 | 13.53 | 14.71 |

| *Annualised Return | Data Through 03/02/2023 | ||

| QUARTERLY RETURNS (%) | Q1 | Q2 | Q3 | Q4 |

| 2023 | - | - | - | - |

| 2022 | -1.26 | -9.45 | 12.16 | 3.98 |

| 2021 | 8.02 | 10.04 | 10.00 | -0.25 |

| 2020 | -27.06 | 20.84 | 9.24 | 23.61 |

| 2019 | 5.82 | -0.84 | -1.90 | 7.25 |

| RISK MEASURES | |

| 3Y Alpha | 0.00 |

| 3Y Beta | 0.95 |

| 3Y R-Squared | 97.12 |

| 3Y Info Ratio | -0.15 |

| 3Y Tracking Error | 3.93 |

| 3Y Sharpe Ratio | 0.59 |

| 3Y Std Dev | 22.21 |

| 3Y Risk | Avg |

| 5Y Risk | Avg |

| 10Y Risk | bel avg |

| Calculations use S&P BSE 500 India TR INR (where applicable) | |

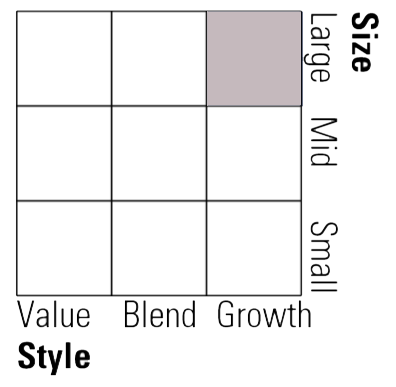

Morningstar Style BoxTM

|

* Report as of 6 Feb 2023

© 2023 Morningstar. All Rights Reserved.

Disclaimer :

© 2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

Cyclical

Cyclical  Basic Materials

Basic Materials  Consumer Cyclical

Consumer Cyclical  Financial Services

Financial Services  Real Estate

Real Estate  Sensitive

Sensitive  Communication Services

Communication Services Energy

Energy  Industrials

Industrials Technology

Technology Defensive

Defensive  Consumer Defensive

Consumer Defensive Healthcare

Healthcare Utilities

Utilities