| Mutual Funds | ||

| DHFL Pramerica Credit Risk Fund Regular Plan Growth |

| OVERVIEW | FUND INFO | PORTFOLIO |

|

Morningstar® Category Credit Risk |

Total Net Assets (mil) 7,045.47 INR |

|

Morningstar® Benchmark CRISIL Short Term Bond Fund TR INR Used throughout report |

Fund Benchmark CRISIL AA Short Term Bond Index |

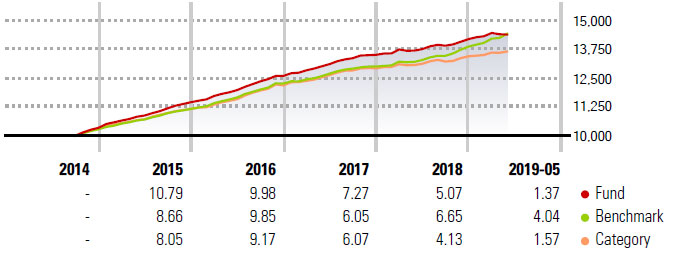

| TRAILING RETURNS (%) | FUND | BENCHMARK | CATEGORY |

| 3M | -3.44 | 2.81 | -2.29 |

| 6M | -1.48 | 5.04 | -0.91 |

| 1Y | 1.52 | 9.24 | 1.47 |

| 3Y* | 5.28 | 7.64 | 4.47 |

| 5Y* | - | - | - |

| 10Y* | - | - | - |

| *Annualised Return | Data Through 18/07/2019 | ||

| QUARTERLY RETURNS (%) | Q1 | Q2 | Q3 | Q4 |

| 2019 | 1.89 | - | - | - |

| 2018 | 1.74 | 0.11 | 1.08 | 2.06 |

| 2017 | 1.95 | 2.11 | 1.95 | 1.08 |

| 2016 | 2.37 | 2.19 | 3.15 | 1.92 |

| 2015 | 3.06 | 2.06 | 2.90 | 2.36 |

| RISK MEASURES | |

| 3Y Alpha | -0.06 |

| 3Y Beta | 0.77 |

| 3Y R-squared | 57.15 |

| 3Y Info Ratio | -0.97 |

| 3Y Tracking Error | 1.08 |

| 3Y Sharpe Ratio | 1.94 |

| 3Y Std Dev | 1.56 |

| 3Y Risk | bel avg |

| 5Y Risk | - |

| 10Y Risk | - |

| Calculations use CRISIL Short Term Bond Fund TR INR (where applicable) | |

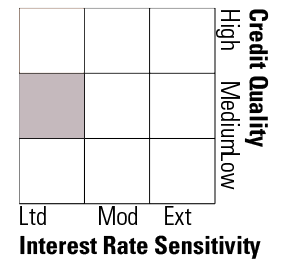

Morningstar Style BoxTM

|

* Report as of 19 Jul 2019

© 2019 Morningstar. All Rights Reserved.

Disclaimer :

© 2019 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

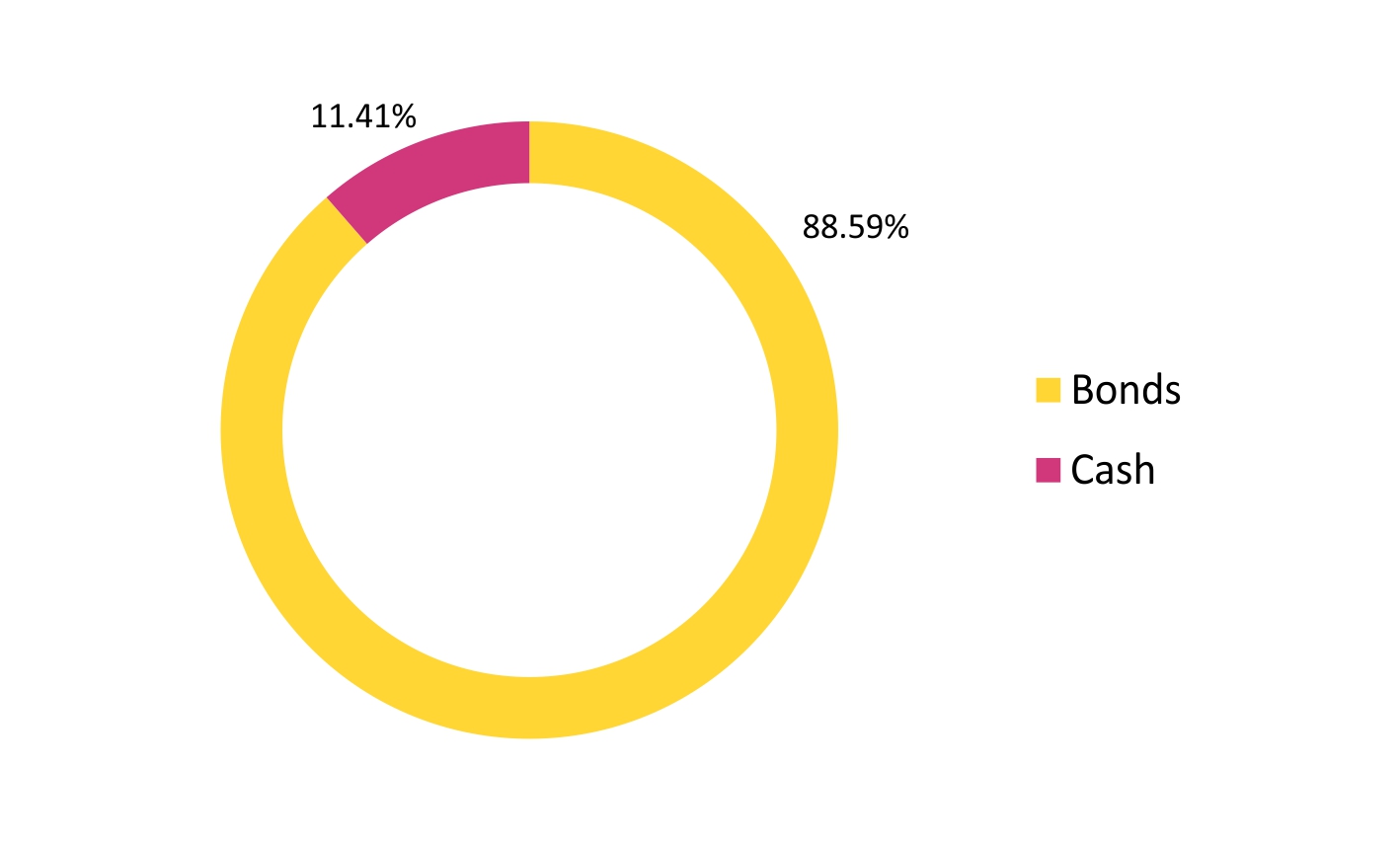

Government

Government Corporate

Corporate  Securitized

Securitized  Municipal

Municipal  Cash & Equivalents

Cash & Equivalents  Derivative

Derivative