07/06/2015

Indonesia / GDP

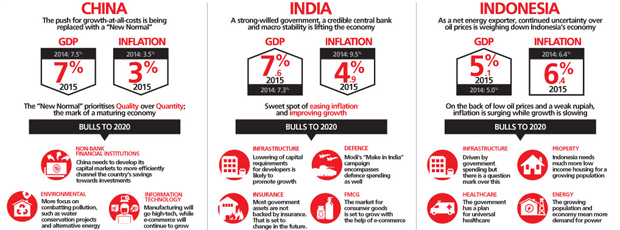

Net foreign inflows remain positive despite concerns over Indonesia’s economic growth and a weakening rupiah. But sentiment may change if authorities do not step up efforts.

Indonesia’s GDP grew by 4.7% on-year in the 2015 March quarter, its slowest since 2009. The Indonesian rupiah is trading at its weakest level against the US dollar since 1997-98. Investors are concerned about the potential for capital outflow but most are staying put, with net foreign inflows into equities remaining positive in the March quarter, at around US$0.3 billion.

Foreign purchases of Indonesian government bonds reached US$6 billion in the first half, about the same pace as in 2014. Since January 2014, foreigners have been net buyers of Indonesian government bonds every month except in December 2014 and March 2015. Despite fears to the contrary, more funds are coming in than going out.

Indonesia’s economy is in a much better shape now than in previous years. Public debt / GDP ratio is at 25%, down sharply from close to 100% in 2000. More importantly, foreign reserves coverage of short-term external debt is above 200%, compared to an average of about 50% in the 3-year period prior to 1997. The current account (C/A) deficit is more sustainable today than in 1997 as well. It is important to note that Indonesia needs foreign capital, and thus, the C/A deficit is appropriate. As long as this C/A deficit is financed by long-term, stable foreign flows, risks are manageable. More foreign direct investment (FDI) is preferred to short-term portfolio flows. Net FDI is now running at about 2% of GDP, compared to 0.8% of GDP back then. The Indonesian rupiah is at its weakest against the US dollar since 1997-98 but much of this is due to broad US dollar strengthening. The rupiah has been fairly stable on effective exchange rate basis since the mid-2013 sell-off. On a real effective exchange rate basis, it has appreciated 7% since the end of 2013.

This is not to say that policymakers can afford to be complacent. Further narrowing of the C/A deficit is warranted (based on FDI trends, 2% of GDP seems more sustainable). A larger C/A deficit would be possible if FDI flows were greater. Despite this year’s introduction of a one-stop shop for investment applications, gross FDI has fallen in the March quarter. Meanwhile, the government is not expected to ease foreign investment restrictions in any sector, anytime soon. On current trends, 2015 FDI could fall below last year’s US$28.5 billion, when most view US$40 billion per year as a reasonable target.

Disconcertingly, the government is perceived to be increasingly interventionist. Among other things, the government has issued new regulations to cap prices of food and basic goods during peak demand periods, in addition to the price caps placed on cement earlier this year. These measures are unlikely to lift demand by much, as long as fiscal spending continues to disappoint. Through May, capital expenditures have only reached 6% of the full-year target. Even assuming disbursement can match the pace seen in the second half of 2014, total capital expenditure spending may reach only 55% of this year’s 275 trillion rupiah target.

Most foreign investors remain invested in Indonesia because of the long-term potential of its economy. But this potential will be undermined if the authorities fail to step up efforts in the second half of 2015, to prevent further slowing in growth. So long as investment is productive, modestly higher debt is sustainable. Indonesia today is far removed from 1997.

Read the full report