06/05/2015

Asia / Equities

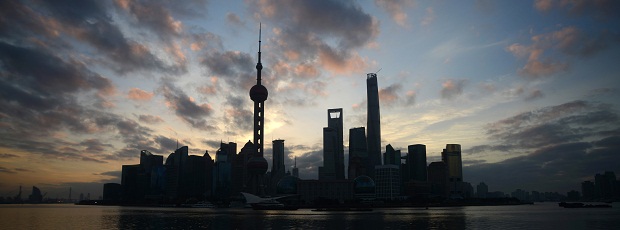

China’s SHCOMP (Shanghai Stock Exchange Composite Index) rose after diving earlier in the day, underscoring the red-hot market’s rising volatility.

China’s SHCOMP rose after diving earlier in the day, underscoring the red-hot market’s rising volatility. Investors were spooked after brokerage Golden Sun Securities cut all margin financing for stocks listed on ChiNext, a start-up board with smaller high-growth, high-valuation companies on its list. The SHCOMP plunged as much as 5.4% before recovering as Golden Sun is a small brokerage, and investors stopped the panic selling. The DBS Chief Investment Office believes the stock market rally will continue, supported by stimulus and ample liquidity. Valuation ratios remain low compared to China market’s past cyclical ranges, and to Developed Markets as well.

South Korea’s economy grew 0.8% on-quarter in 1Q-15. This was in line with expectations and is faster than the 0.3% pace seen in 4Q-14. Growth was led by the construction sector, as production gained 2% and investment increased 7.4%. However, private consumption ticked up only 0.6%. Exports, which account for about half of the economy, also disappointed with a tepid 0.1% raise. Growth in Asia’s fourth-largest economy has stayed below 1% for four quarters.

Southeast Asia equities fell after energy plays ticked lower, tracking weaker global oil prices. Thailand’s SET slid 0.2% after the University of the Thai Chamber of Commerce said that consumer confidence fell for the fifth straight month in May due to jitters over economic recovery, weaker energy prices, declining exports, and droughts.