Banker's Guarantee | Standby Letter of Credit | DBS SME Banking Indonesia

- Trade

- Related Services

- Banker’s Guarantee / Standby Letter of Credit

Banker’s Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

- Trade

- Related Services

- Banker’s Guarantee / Standby Letter of Credit

Banker’s Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

At a Glance

Reassure your buyers or sellers of payment no matter what happens.

An independent undertaking

Banker’s Guarantees are independent undertakings which help to mitigate payment risks for the beneficiary

Submit your application through any DBS or POSB branch, or DBS IDEAL

Added assurance

We will pay to your beneficiaries upon receipt of a claim that complies with the terms of the guarantee

Easy collection

Pick up your banker’s guarantee from any of our Trade Document Counters and DBS collection branches

Features

- Payment Guarantee – This protects the beneficiary in the event that the applicant fails to honour the payment under their contract

- Bid Bond – This enables the applicant (bidder) to use DBS’ credit to support the bid, and can also be used to insure the successful bidder that the contract will be met

- Performance Bond – Some bidding contracts require the successful bidder to provide a performance guarantee to protect against a default

- Financial Guarantee – This helps the applicant’s overseas subsidiaries obtain financing or credit facilities from banks

- Guarantees are subject to Indonesian Law, URDG ICC pub. 758, UCP 600, or ISP 98

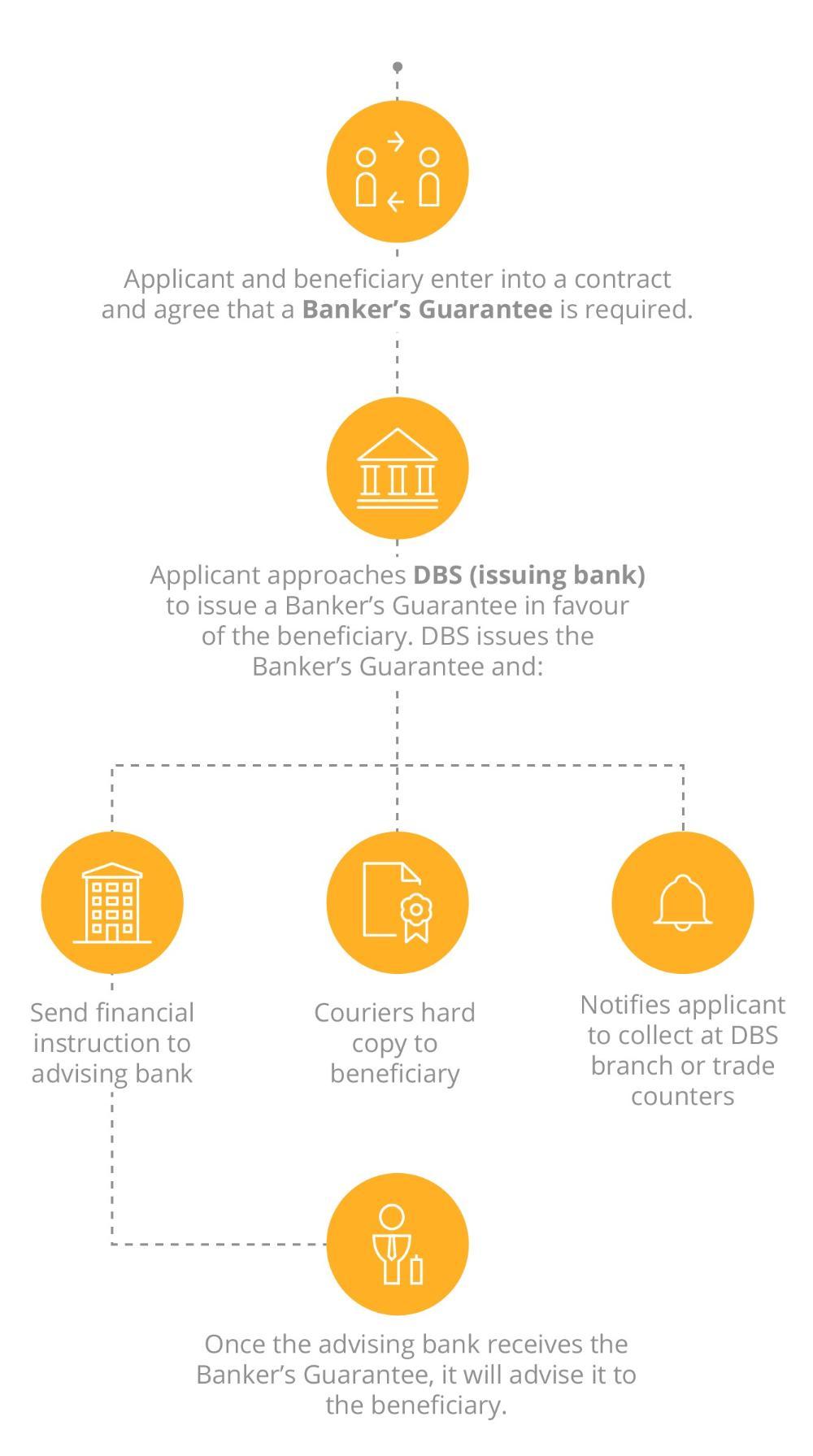

How it Works

FAQs

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?